URD 2022

-

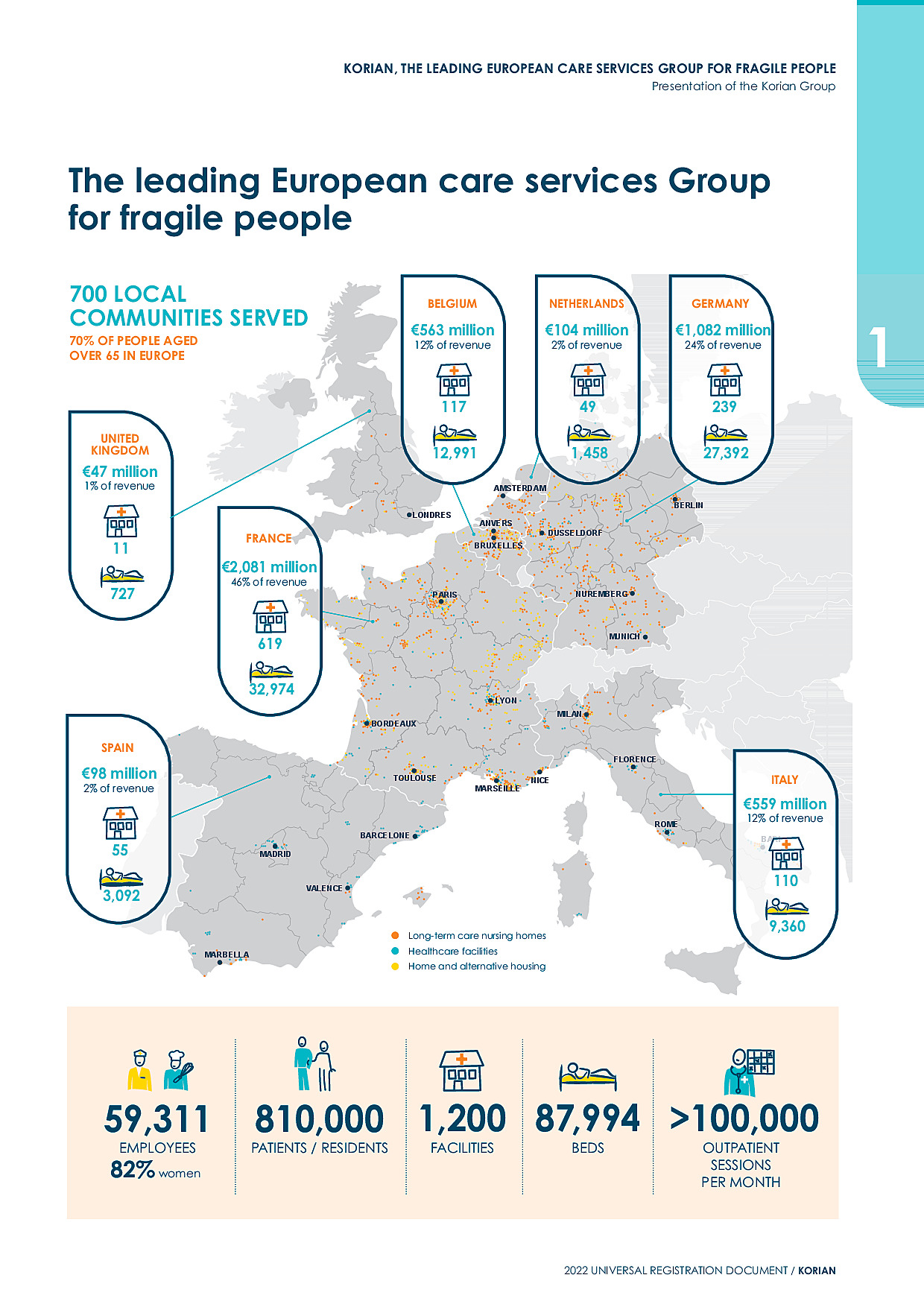

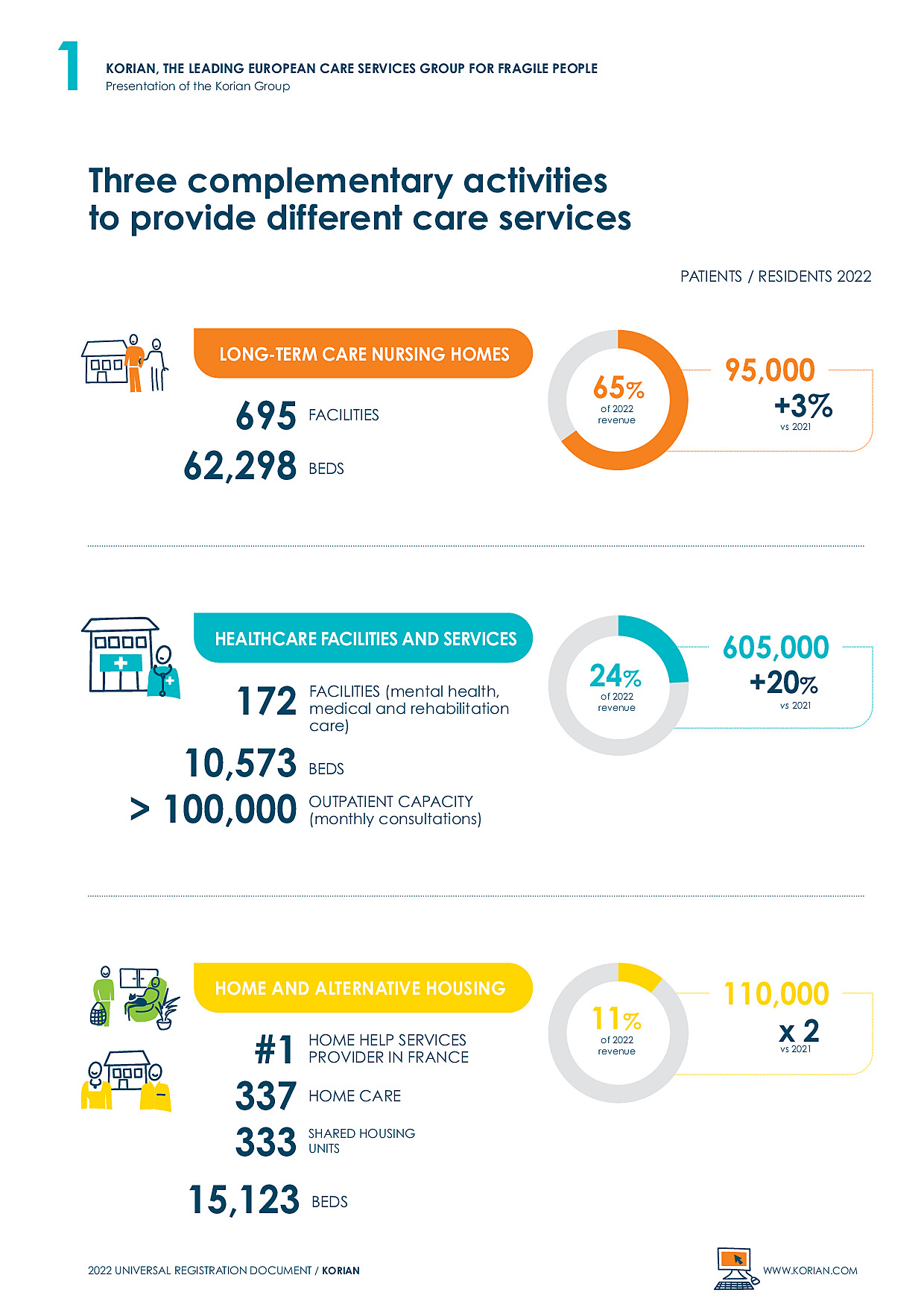

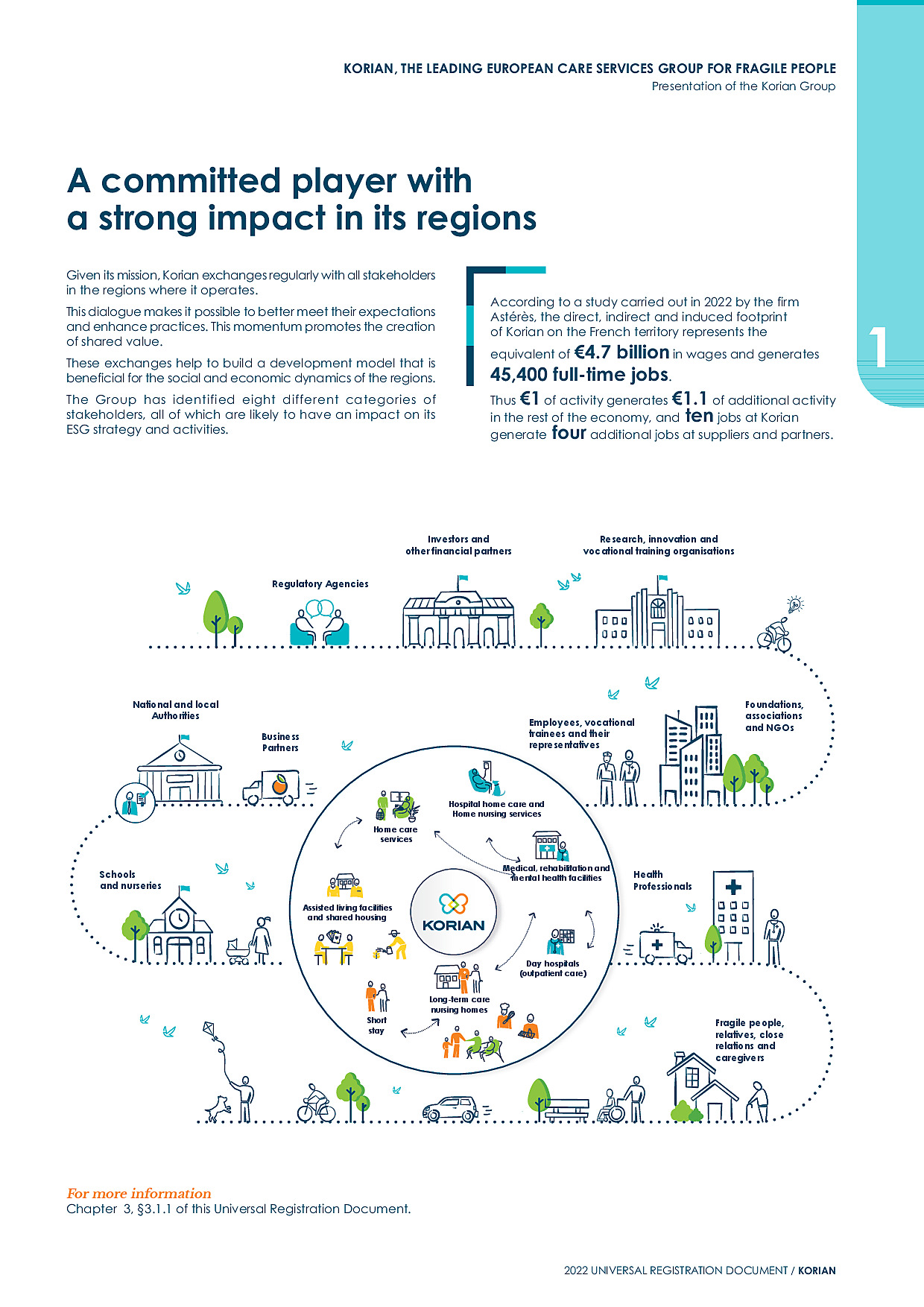

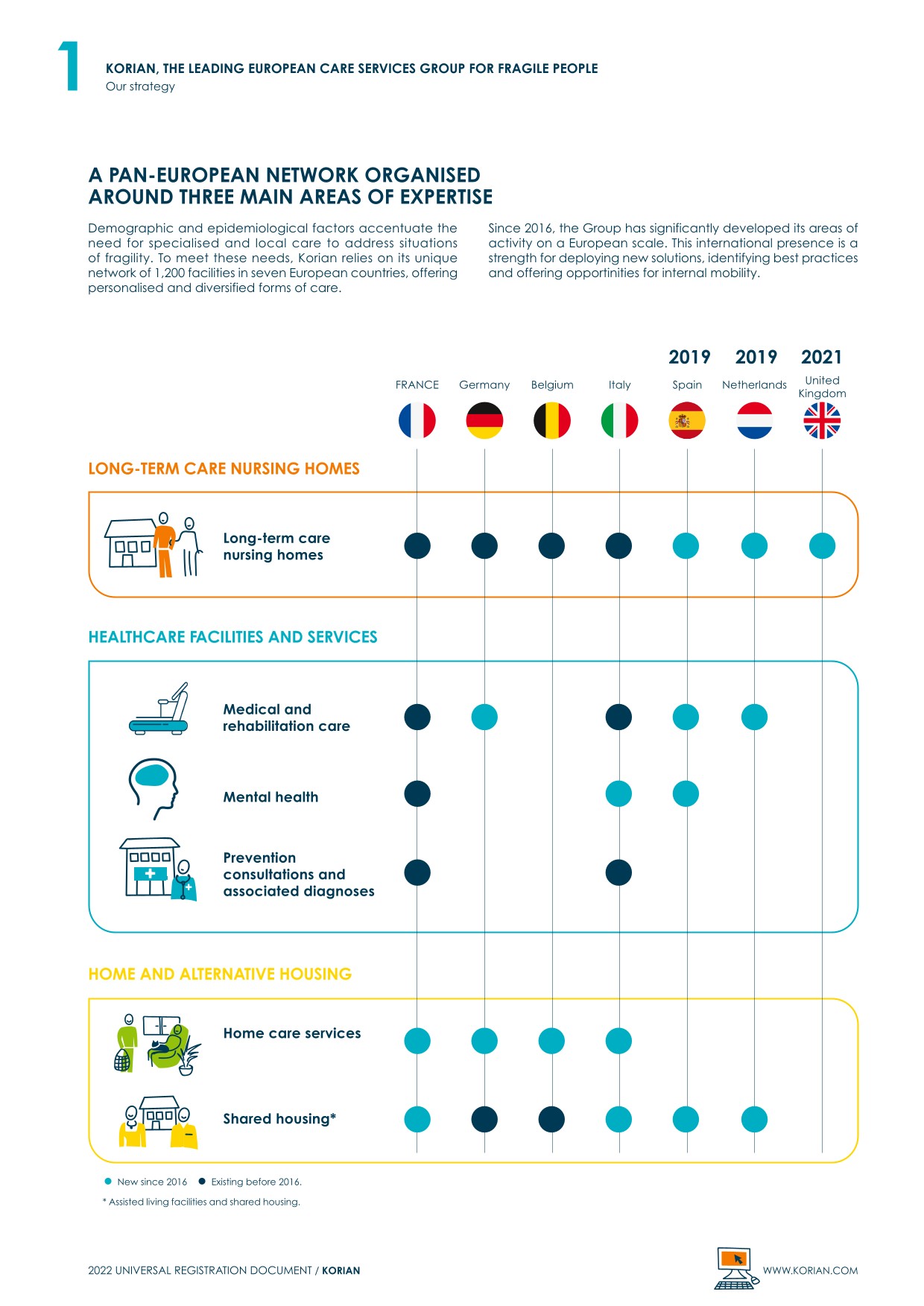

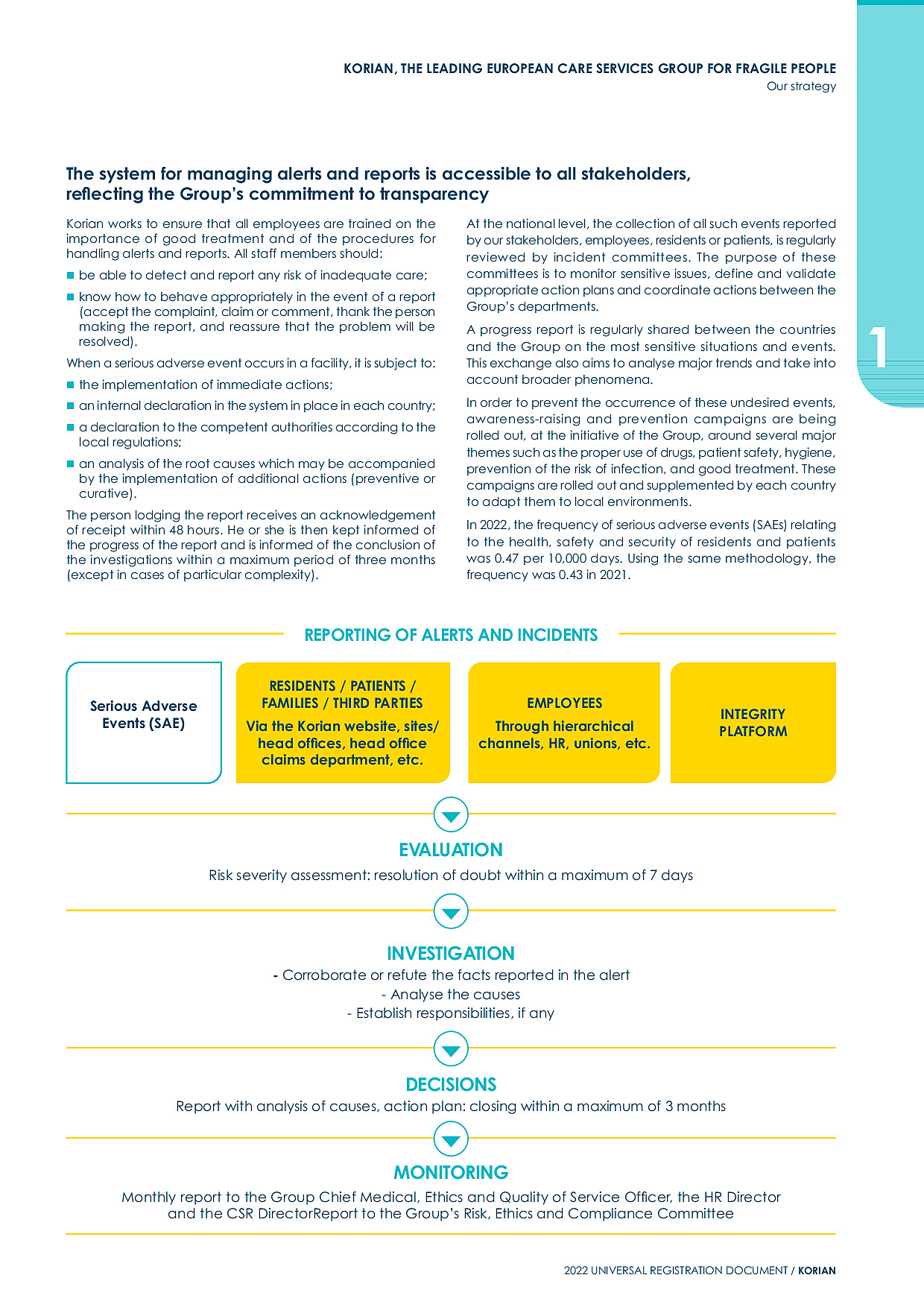

1. Korian, the leading European care services group for elderly and fragile people

-

2. Risk factors

- ■ensure the quality of operations;

- ■protect the Company’s reputation and the value of its assets;

- ■secure the Company’s decision-making and processes;

- ■ensure that the actions taken are consistent with the Company’s values;

- ■mobilise the Company’s employees around a common vision of the most material risks.

Risk management within the Group is based on a risk monitoring and identification process. The risks are analysed and preventive or corrective measures are implemented to reduce their potential impact.

- ■a bottom-up analysis – to collect operational managers’ point of view and the contributions of each country;

- ■a top-down analysis – driven by General Management and the Group’s functional division heads.

- ■the highest probability of the risk materialising; and

- ■the estimated scale of its maximum potential negative impact (non-financial, in particular operational, and financial).

The risk management framework allows weighting of the gross probability, the gross impact or both criteria, which gives the net criticality of the risk.

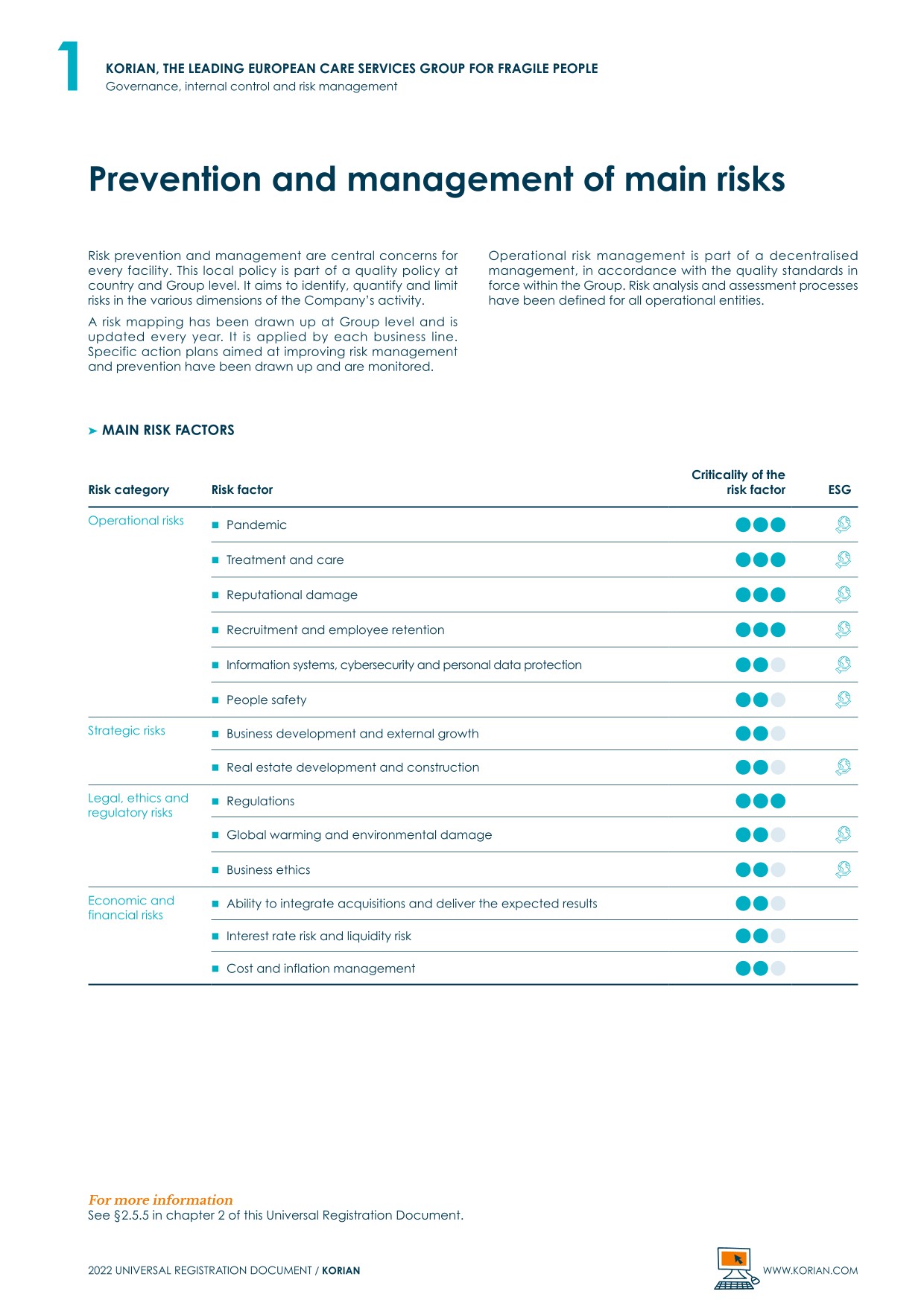

A presentation of the risk factors by category is summarised in the table below, with the net criticality of each risk factor indicated according to the three-level scale: low, medium or high. As this Universal Registration Document only presents significant risks, no low-level risks are mentioned.

The risks are classified by decreasing level of criticality within each category (operational risks, strategic risks, legal, ethics and regulatory risks, or economic and financial risks).

The Group implements action plans as part of a continuous improvement process. Furthermore, it has taken out insurance coverage to externalise some of the risks.

The risks presented below are those that the Company considers, as of the date of this Universal Registration Document, to be likely to have a significant impact on the Group or of which stakeholders should be made aware.

Risk category

Risk factor

Criticality of the risk factor

ESG

Operational risks

- ■Pandemic

High

- ■Treatment and care

High

- ■Recruitment and employee retention

High

- ■Reputational damage

High

- ■Information systems, cybersecurity and personal data protection

Medium

- ■People safety

Medium

Strategic risks

- ■Business development and external growth

Medium

- ■Real estate development and construction

Medium

Legal, ethics and regulatory risks

- ■Regulations

High

- ■Global warming and environmental damage

Medium

- ■Business ethics

Medium

Economic and financial risks

- ■Ability to integrate acquisitions and deliver the expected results

Medium

- ■Interest rate risk and liquidity risk

Medium

- ■Cost and inflation management

Medium

In each category, the risk factors are presented in order of importance, starting with the most significant:

- ■presentation of gross risk, as it exists as part of the Company’s business;

- ■presentation of the management systems implemented by the Company.

Other risks may emerge in the future and give rise to a materially adverse impact. The above list of risks is therefore not exhaustive.

-

2.1Operational risks

2.1.1Pandemic ✪

2.1.1.1Description of risk

Despite technological and medical progress, the pandemics linked to Covid-19 and the H1N1 virus have shown humanity's vulnerability to pathogens. New potential threats to health could arise due to the melting of polar ice, the multiplication of crises or another factor not yet known. Infectious diseases could thus spread across the world.

2.1.1.2Risk management framework

In the context of the Covid-19 pandemic, the Group established a vigilance plan that has demonstrated its effectiveness and could be rapidly redeployed in all of its establishments and in all its countries of operation (long-term care nursing homes and healthcare facilities ) in the event of a new pandemic. This European standard is continuously updated to incorporate best practices in terms of hygiene, traceability and prevention measures.

The Group also ensures that its network always has a steady supply of protective equipment (masks, gloves, etc.) by building up a permanent stock corresponding to two months of consumption. Hygiene diagnostic campaigns covering all European facilities were entrusted to Bureau Veritas from 1 July 2020, with the aim of checking the proper application of these standards and assisting the teams in their implementation.

-

2.2Strategic risks

2.2.1Business development and external growth

2.2.1.1Description of risk

The Group implements a development policy to support the strengthening of the Group’s medical activity.

The implementation of this strategy requires the ability to find suitable targets and development opportunities at acceptable costs and conditions, as well as the implementation of appropriate integration processes, in order to guarantee a high level of quality across the networks.

2.2.1.2Risk management framework

At Group level, Korian has a dedicated department whose duties include reviewing partners and strategic opportunities, selecting them, carrying out audits and conducting negotiations.

This department relies on rigorous multi-criteria analysis procedures involving external audits and expert opinions. These audits cover operational, quality, and ethics and financial issues.

These analyses make it possible to identify the risks and take them into account when determining the acquisition price of the target and thus limit the risk of overvaluation. Furthermore, the teams in charge of integration are involved in the acquisition audit process with the aim of preparing a preliminary integration plan, in order to minimise the integration risk. This plan will be completed and validated following the acquisition.

Any proposed investment or divestment exceeding €1 million, including partnerships and acquisitions of equity interests, whether or not it results in control being acquired, is subject to the approval of Korian’s Commitments and Investment Committee.

Furthermore, projects with an enterprise value in excess of €15 million or in a new country or outside the scope of the Group’s pre-existing business lines (determined at the local level) must be approved by the Board of Directors on the recommendation of the Commitments and Investment Committee of the Board.

-

2.3Legal, ethics and regulatory risks

2.3.1Regulations

2.3.1.1Description of risk

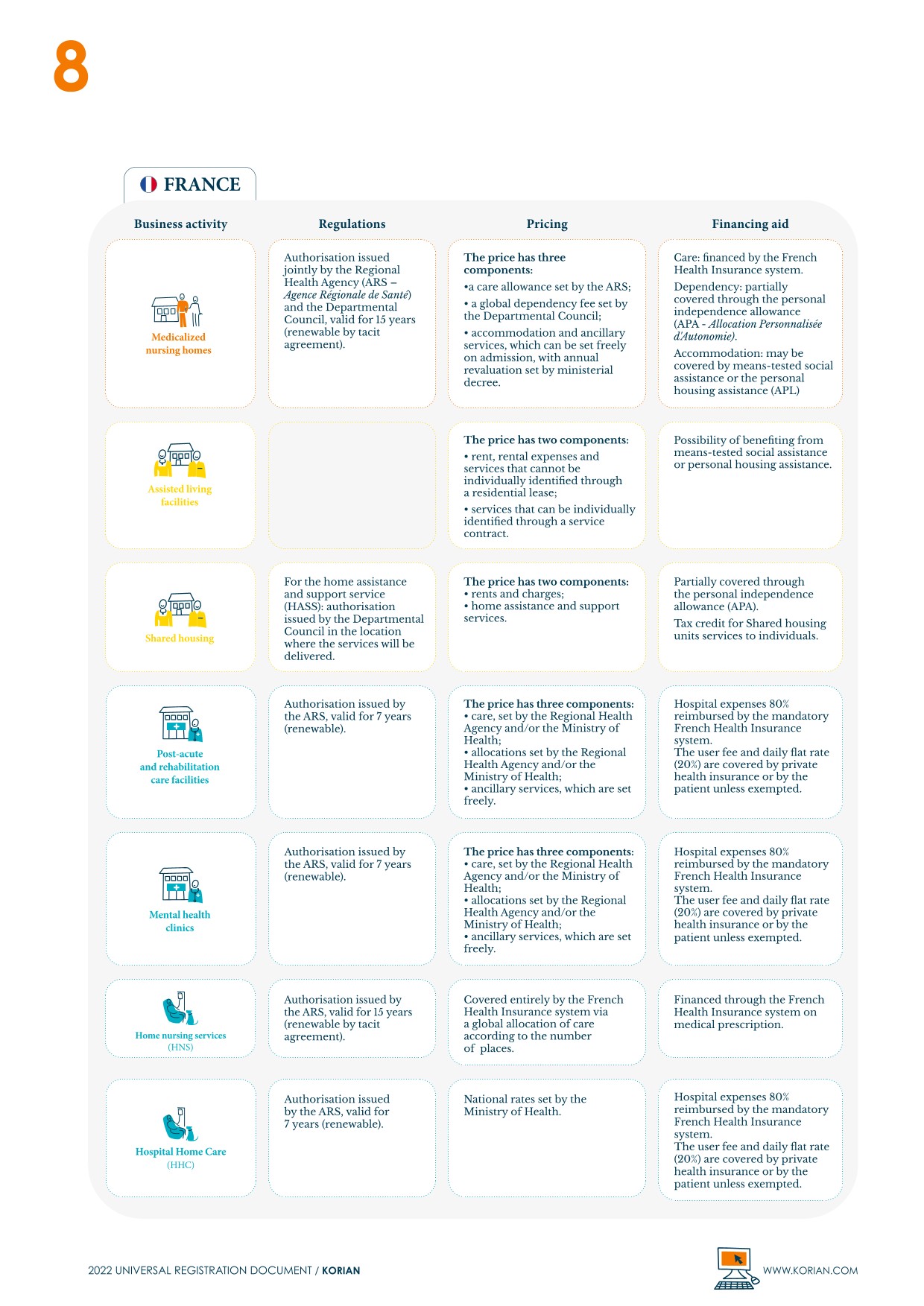

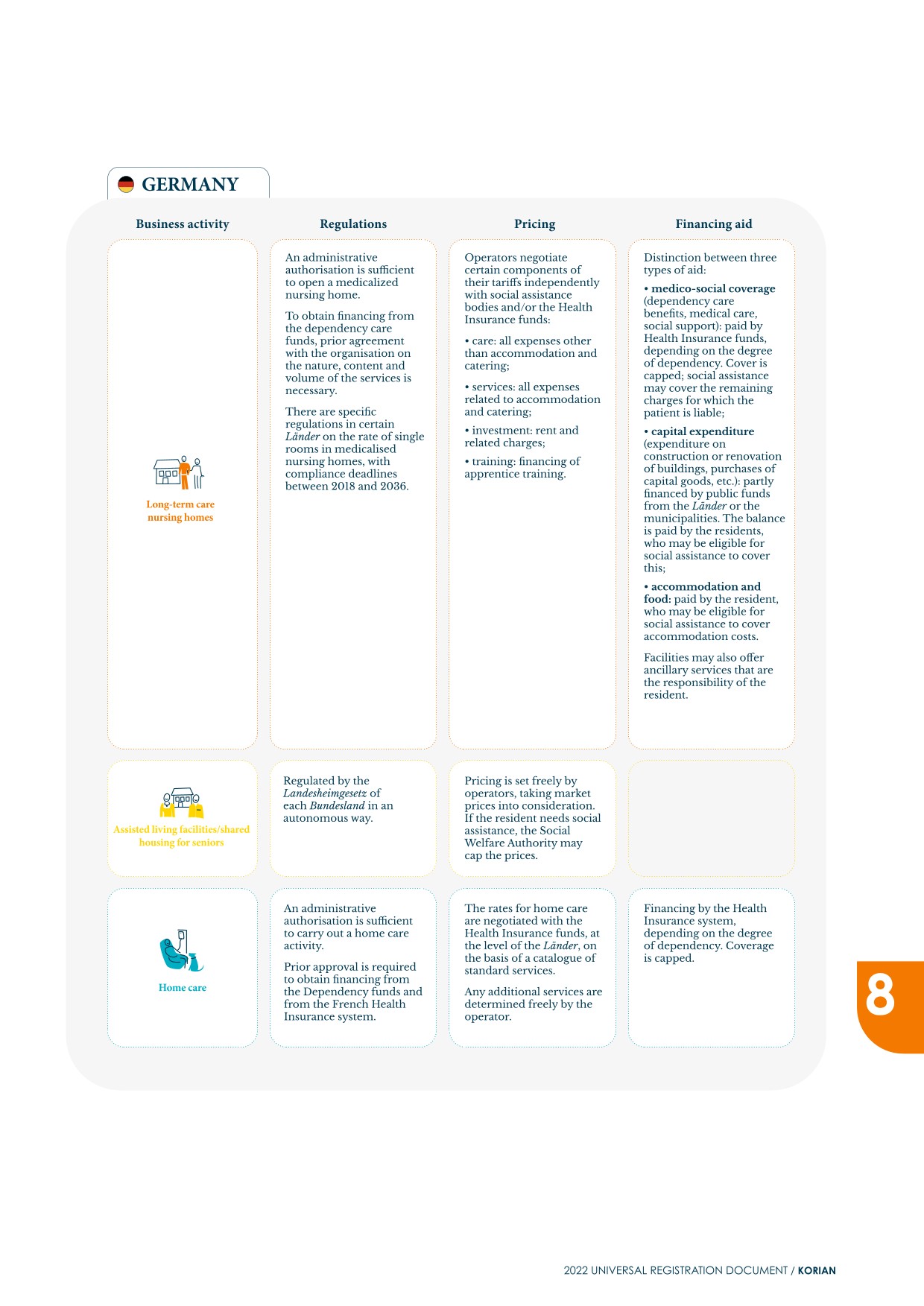

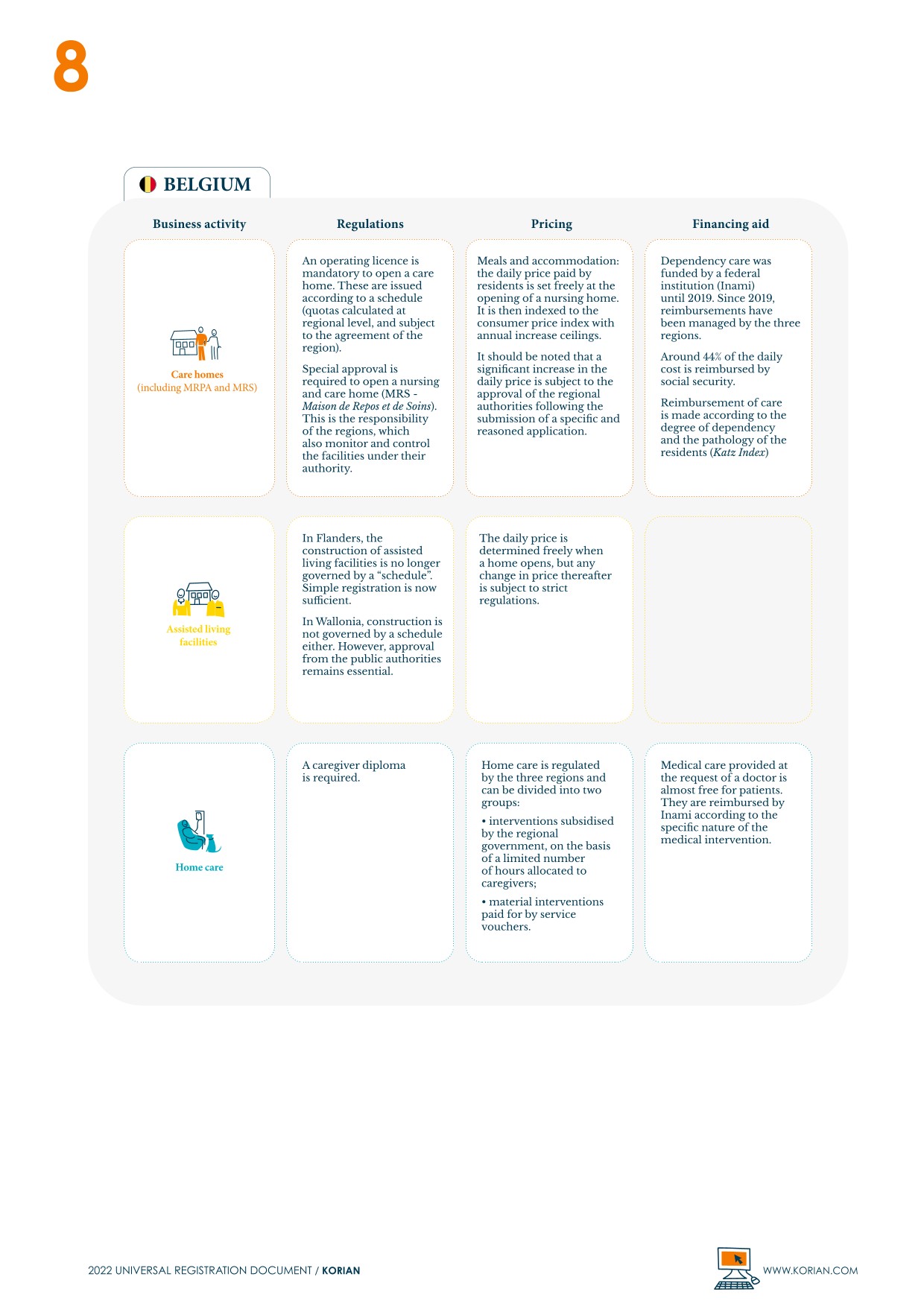

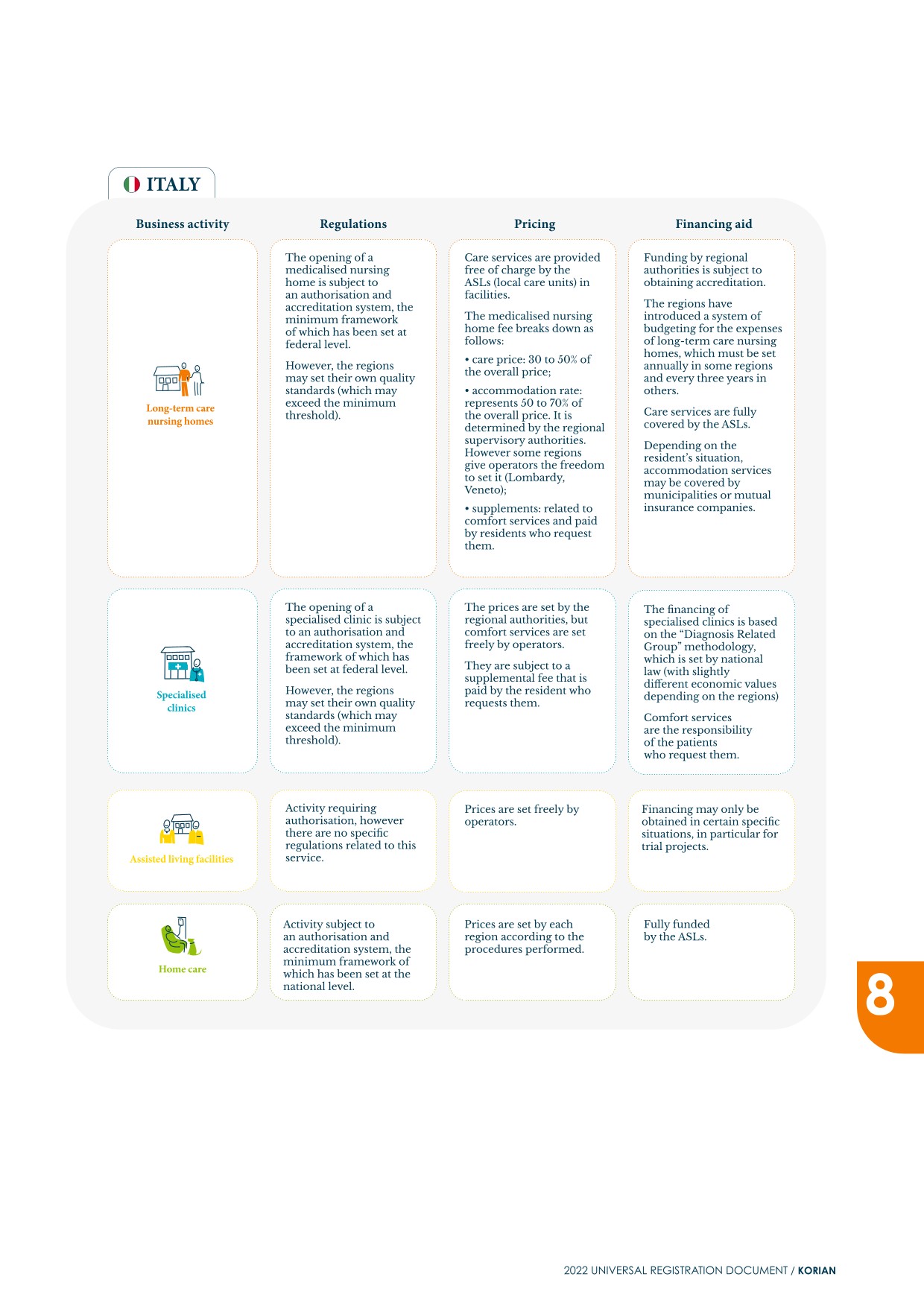

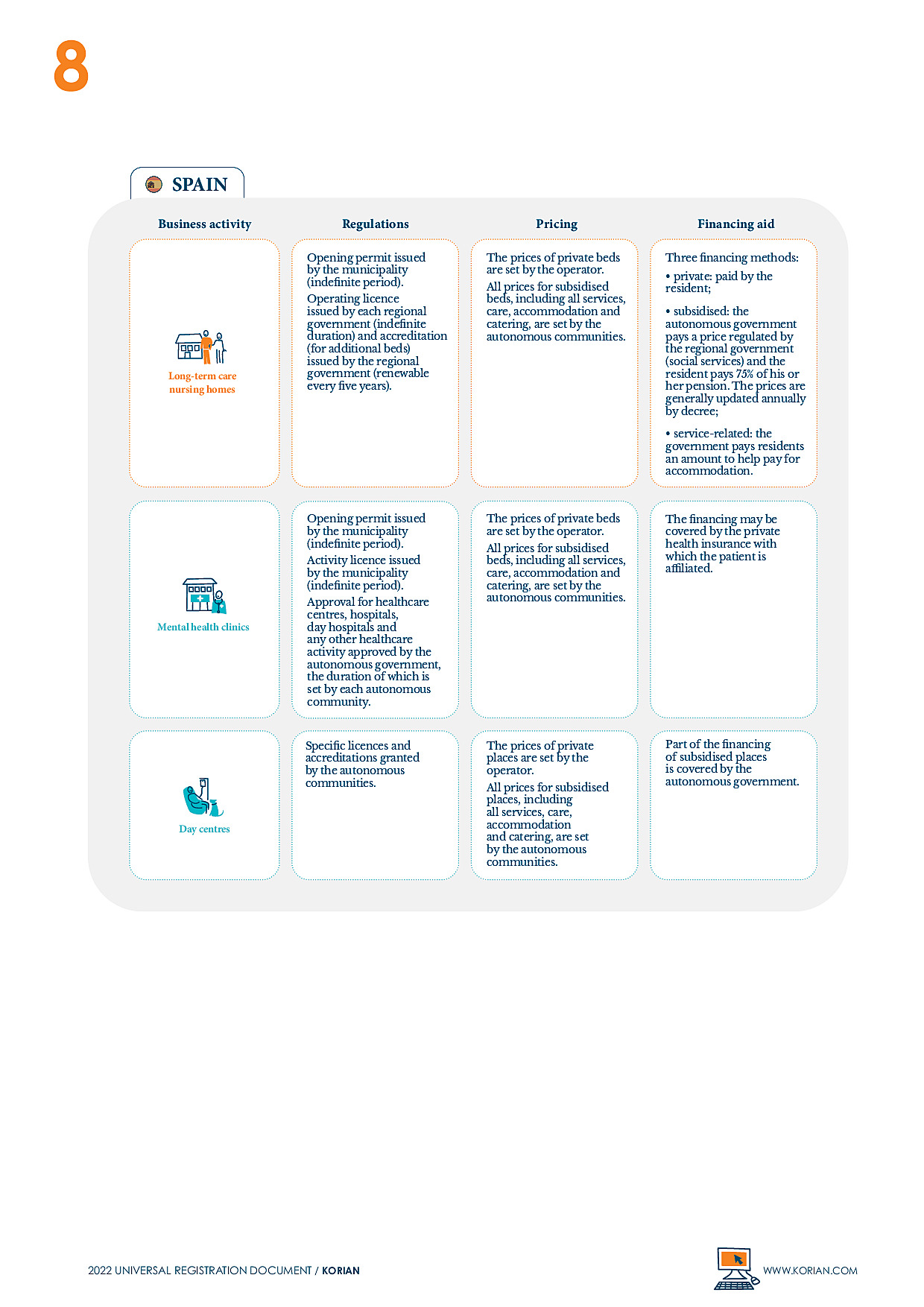

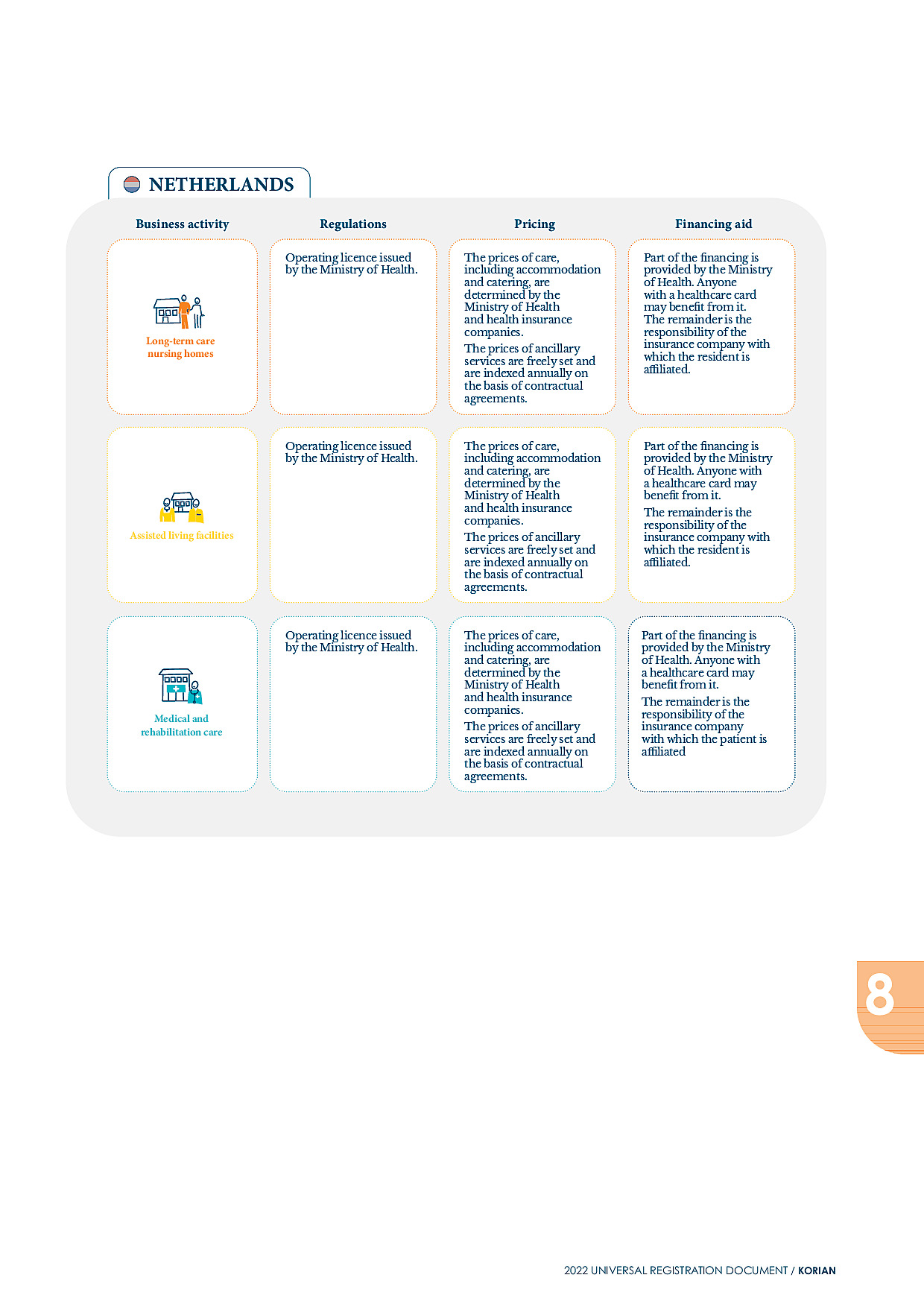

The Group’s medico-social and healthcare activities are subject to laws and regulations in all countries where it operates. In most countries the opening of a medico-social or healthcare facility requires authorisations to be granted. Authorisations are generally issued or renewed subject to compliance of the service provision with assessment and quality control procedures conducted by the supervisory authorities in accordance with the applicable laws in each country.

- a portion paid by the residents or patients themselves;

- a portion relating to treatment and care, directly or indirectly subsidised by public funding.

2.3.1.2Risk management framework

In order to ensure the proper application of the rules on the use of financing, Korian provides Facility Directors with access to information systems that provide a framework for the allocation of resources to the appropriate category of expenditure (care, dependency or hospitality). The same applies to expenses related to medical equipment and devices. The reports produced are subject to controls at facility level and then at central level.

The Group conducts regulatory watch in all of the countries where it operates in order to protect itself against any negative repercussions resulting from changes to regulations or pricing rules. This watch enables the Group to anticipate any major changes while ensuring the compliance of its operations. The Group is also an active participant in trade union activities.

-

2.4Economic and financial risks

Korian’s activities are based on a fixed cost structure and its dynamic development requires sustained investment. The Group is therefore exposed to risks related to liquidity, volatility and inflation in financing conditions, as well as its ability to integrate acquisitions in order to deliver the expected results.

The Group has set up various sources of funding that are described in Note 8 to the financial statements.

At 31 December 2022, the Group’s total net indebtedness amounted to €3,775 million (excluding lease commitments), and the average maturity of the Group’s financial borrowing was 4.8 years (excluding short-term debt offset by available cash at closing).

2.4.1Ability to integrate acquisitions and deliver the expected results

2.4.1.1Description of risk

Korian’s ability to rapidly integrate acquisitions is fundamental to pursuing its development strategy.

In 2022, 20 facilities were integrated or were in the process of being integrated. In particular, this involves acquisitions in Italy, including Italian Hospital Group, and in the United Kingdom.

The Group could encounter difficulties or suffer delays in the integration of these assets, impacting the quality of the services provided, the acquisition of control, the expected synergies and its ability to deliver the expected results.

2.4.1.2Risk management framework

The Group has significant experience in the integration of acquisitions. Starting from the phase of identifying potential targets, the assets the Group is considering acquisition of are subject to in-depth analyses carried out by multidisciplinary teams in order to reduce uncertainties and understand the risks that may arise during integration.

As described above, any proposed investment or divestment exceeding €1 million, including partnerships and the acquisition of equity interests, whether or not control is acquired, is subject to the approval of Korian’s Commitments and Investment Committee.

Furthermore, projects with an enterprise value in excess of €15 million or in a new country or outside the scope of the Group’s pre-existing business lines (determined at the local level) must be approved by the Board of Directors upon the recommendation of the Commitments and Investment Committee of the Board.

Every country has a dedicated department whose role is to supervise, support and monitor integrations. These departments are coordinated at Group level. A specific process has been set up in order to:

- ■structure the integration process;

- ■identify and address the risks;

- ■monitor the successful implementation of the business plan;

- ■ensure that the ESG requirements set by the Group are properly met; and

- ■ensure that the Group’s systems and standards are implemented within the desired timeframes.

-

2.5Internal control and risk management

The Group has drafted and implemented an internal control and risk management procedure based on the recommendations set out in the AMF’s reference framework (entitled “Reference Framework on risk management and internal control measures”) (the “Reference Framework”).

The risk management and internal control measures complement the control of the Group’s activities. The risk management framework aims to identify and analyse the most material risks and then address them through appropriate action plans. The controls to be implemented as part of these action plans are part of the internal control procedures. The latter thus contribute to the treatment of the risks to which the Company’s activities are exposed.

The internal control system is applied to the Company and to all companies within its scope of consolidation.

2.5.1Definition and objectives of internal control

Internal control refers to all Group processes that contribute to the rigorous and efficient management of its business activities and the control of its risks.

- ■ensure compliance with laws, regulations and the Group’s values;

- ■ensure accounting and financial information is reliable and accurate;

- ■protect the Group’s assets and reputation;

- ■ensure targets are reached; and

- ■prevent and detect fraud and irregularities.

The internal control system is intended to provide reasonable assurance that these objectives are being achieved.

Internal control is based on a centralised structure with a policy of delegating powers and responsibilities to the Group’s operational and functional departments. In particular, the Group ensures that:

- ■its strategy and operational goals are clearly communicated;

- ■optimal guidance is provided to assist everyone in their work, in particular by sharing Best Practices;

- ■its employees have the skills and resources they need to perform their work. To this end, the Human Resources Department in all countries where the Group operates has assessment, periodic monitoring and training procedures in place;

- ■processes are carefully controlled.

-

3. Environmental, social and corporate governance

A Message from Rémi Boyer, Chief Human Resources Officer

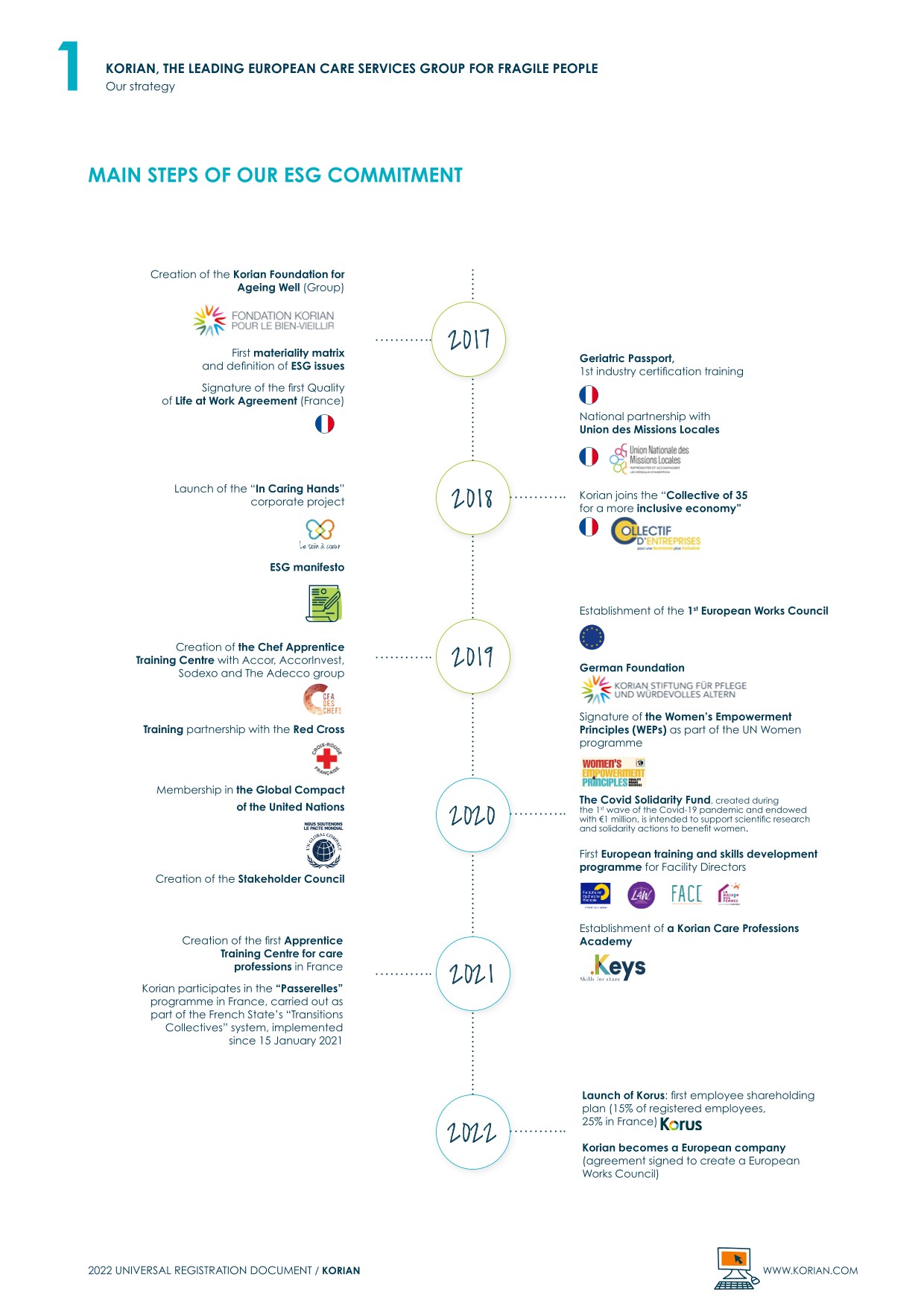

2022 saw consolidation of our CSR progress in a context of continued growth, particularly in the United Kingdom and Spain. It also marked our achievement of most objectives from the ESG roadmap set in 2020 as part of our “In Caring Hands” corporate project.

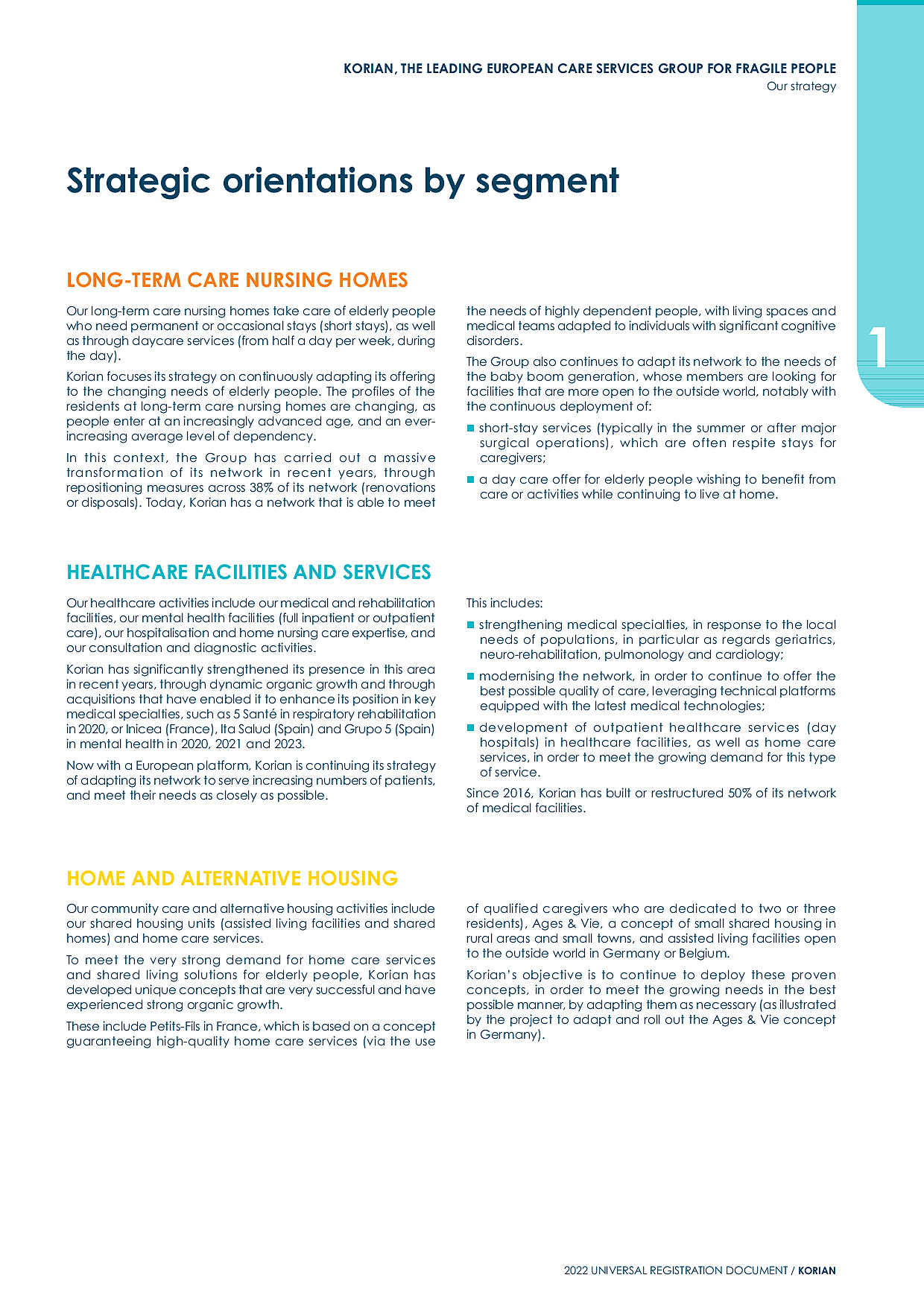

These results are reflected in the strengthening of our quality-of-care standards. More than two thirds of our sites are now ISO 9001 certified and our “Positive Care” approach has been deployed in 97% of our facilities.

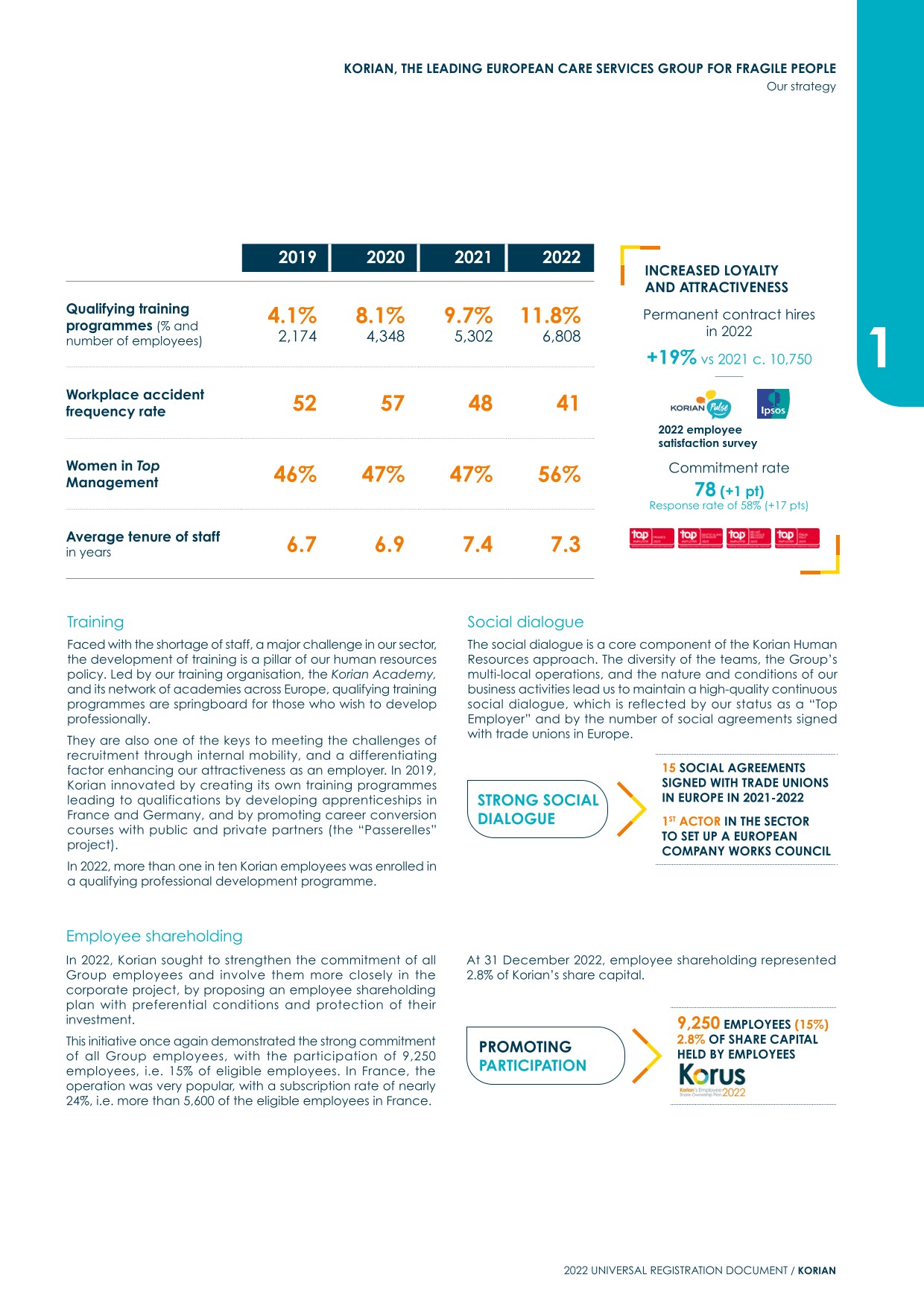

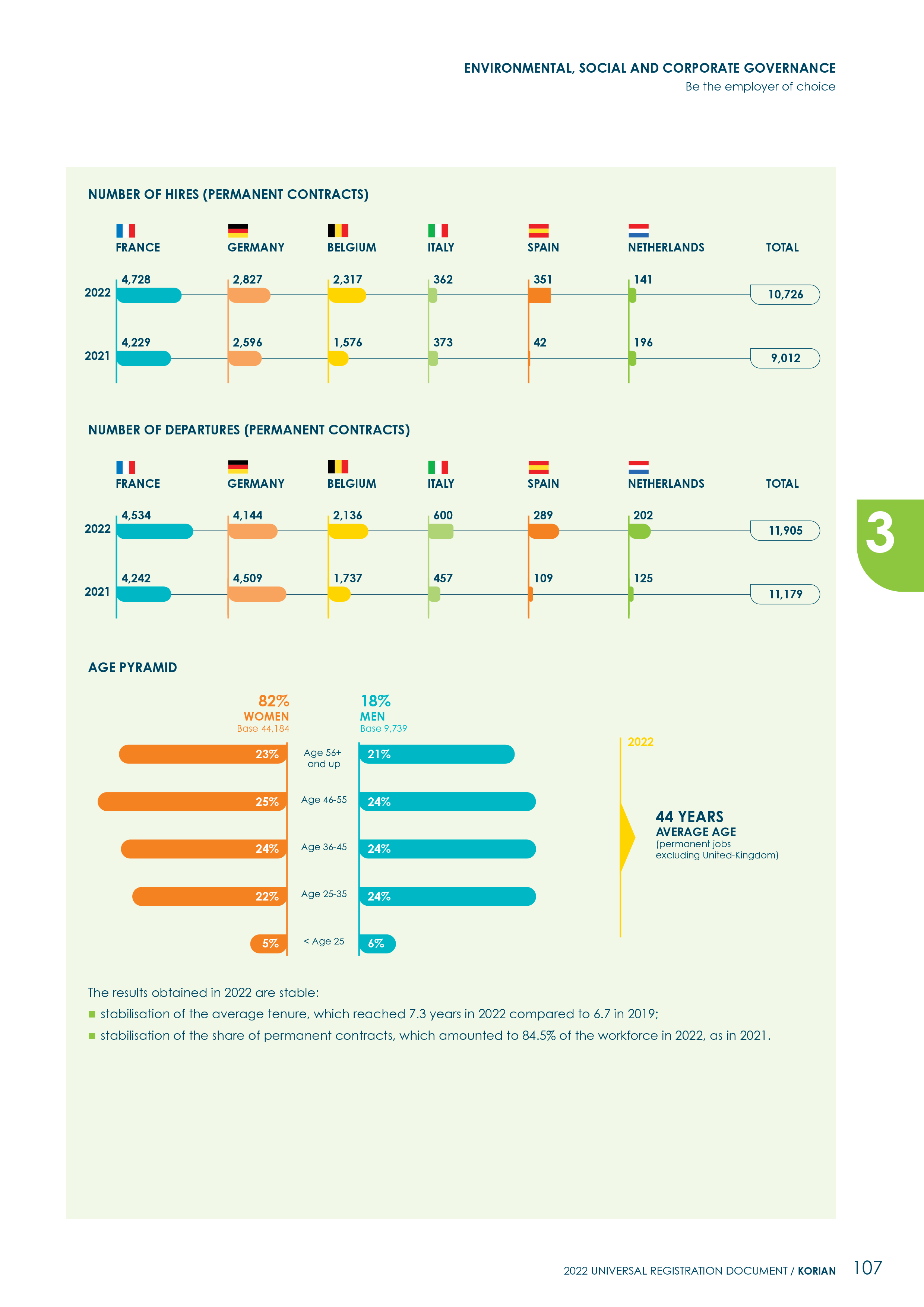

Meanwhile, 12% of our employees, i.e. close to 7,000 people, benefited from a qualifying training programme in 2022, illustrating that our Company is positioned as a proactive learning organisation that makes it possible for everyone to progress within the Group. At 7.3 years, our employees’ average tenure also bears witness to the quality of the Group’s human resources policies and our employer brand. Indeed, we are proud to have earned, the “Top Employer” label for 2022 in four of the Group’s major countries, in France for the second time, in Germany for a third, and in Belgium and Italy for the first time.

We serve 700 catchment areas. Being embedded in the community is therefore essential to ensuring quality relationships with local stakeholders. We are continuously structuring these relationships, both via our Social Life Committees and, at the national level, Stakeholder Councils in five of our seven countries.

The significant energy tensions caused by the Russia‑Ukraine conflict have, of course, prompted us to accelerate efforts to reduce energy consumption and inflect the low‑carbon trajectory defined in 2020. As a result, our carbon intensity ratio, calculated in terms of the Group’s surface area, decreased by 25% in 2022 versus 2019. Our CDP score improved from D to B, recognising the Groupwide progress of our environmental management processes. We therefore confirm the carbon trajectory of -40% emissions intensity established in 2019.

We are entering 2023 with strong momentum from these achievements. This will be a pivotal year for our CSR ambition, as it is both the last year of our 2019‑2023 CSR roadmap and the first year of our transition to the status of a purpose-driven company. To support this change, in 2023, the CSR Department will become part of the Group Brand & Commitment Department. This department was recently created to oversee the new roadmap, which is closely linked to the commitments of our corporate purpose, and has been entrusted to my colleague, Marion Cardon, who will pursue this ambition with energy and determination.

A MESSAGE FROM MARION CARDON, Chief BRAND and engagement Officer

It has now been several years since we first established a CSR strategy and roadmap to address environmental and societal challenges. In becoming a purpose-driven company, we are once again taking a key step, by including our commitment to the common good in our Articles of Association. This formalises, in a sustainable and enforceable way, our duty to consider our stakeholders’ expectations and our societal impact as we design and implement our corporate strategy.

The year 2022 was punctuated by stages in the development of our project. The first involved extensive consultation with our myriad stakeholders: residents, patients and their families, employees and employee representative bodies, representatives from the various local communities where we operate, and investors. In all, we asked more than 1,500 people about their needs and expectations regarding Korian’s purpose, with respect to them directly and more generally for society.

These powerful, complementary and constructive exchanges outlined a clear course of action. This orientation, in turn, enabled us to identify and formulate an identity and purpose, as well as the priority social and environmental objectives through which we want to bring positive value to society.

In 2023, we will continue the process of integrating our purpose and objectives into our Articles of Association, as well as their concrete implementation in the field, with the creation of a standing Mission Committee. Setting up solid and dedicated governance structures will enable everyone to contribute to achieving our purpose and its objectives.

With this transition, we institute that our societal commitments must be central to each of our actions, driven by ambitious CSR objectives that are enabled by the maturity we have acquired on these subjects in recent years and by the daily involvement of all. We are already working to prepare our next CSR roadmap for 2024‑2026. This will be an expression of our ambition and our responsibility, integrating our commitments as a purpose-driven company. The Group’s CSR Department will play a key role in bringing together and mobilising the Group’s employees, who are essential to this transformation.

-

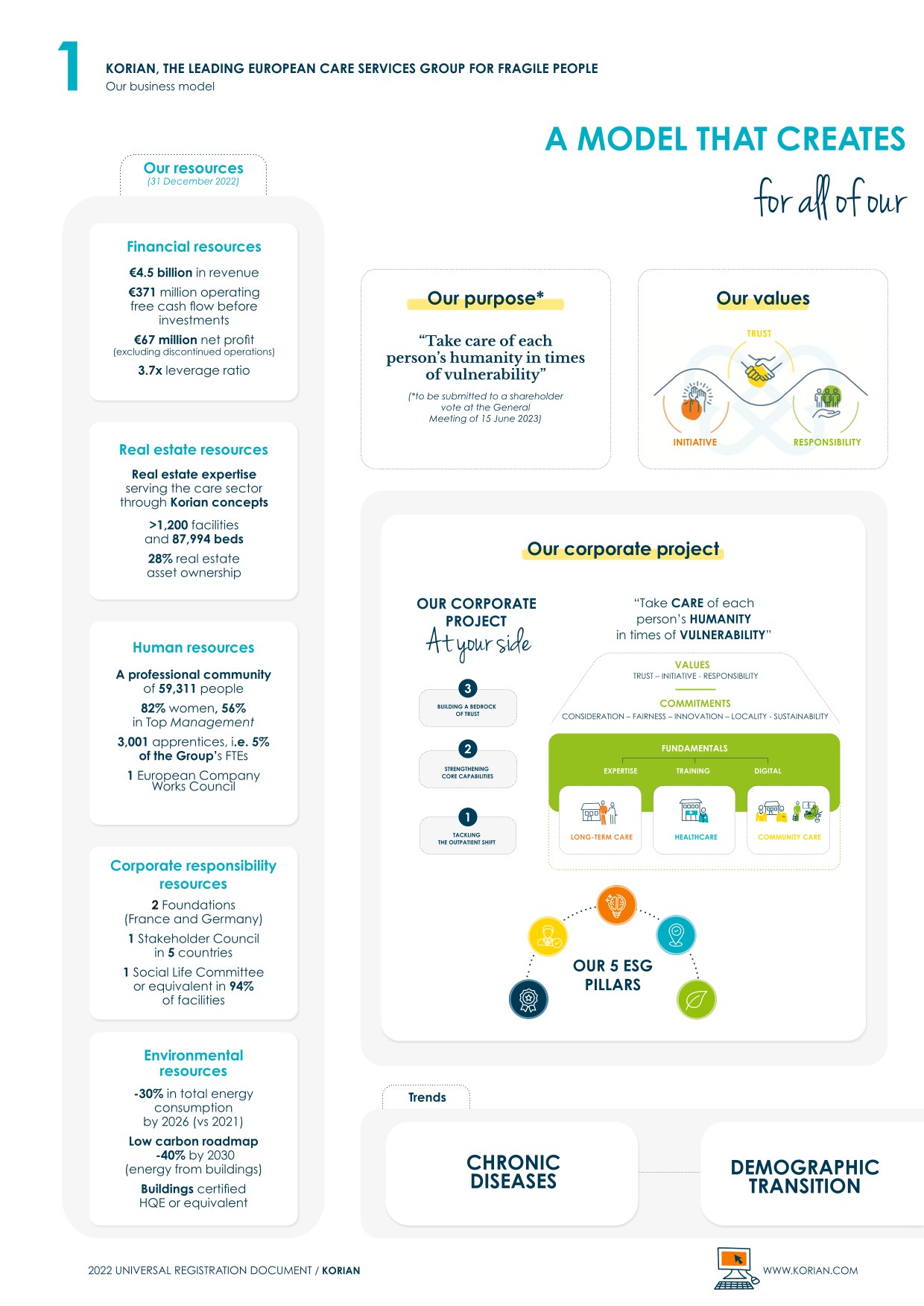

3.1An ESG strategy integral to the corporate project

3.1.1A roadmap focusing on 5 pillars and 15 commitments

The social and societal nature of Korian’s mission means that the Company plays a special role in society. This rests on the heightened sense of responsibility felt by all members of the Company to meet the major challenges of an ageing population in Europe.

A mission closely tied to societal challenges

The Group’s societal role is at the heart of its mission to “Provide care and support to elderly or fragile people and their loved ones, respecting their dignity and contributing to their quality of life” and of its corporate project. It is manifest in each of Korian’s facilities in Europe, which are deeply rooted in their communities, aware and sensitive to the social and environmental realities of their countries. We are proud of our mission of serving the most fragile and elderly among us.

As an extension of these commitments, and in accordance with the mandate given by our shareholders at the General Meeting of 22 June 2022, we have become a European company and have engaged in dialogue with all our stakeholders in order to prepare for transition to the status of a purpose-driven company, which will be submitted to a vote by our shareholders at the General Meeting convened for 15 June 2023.

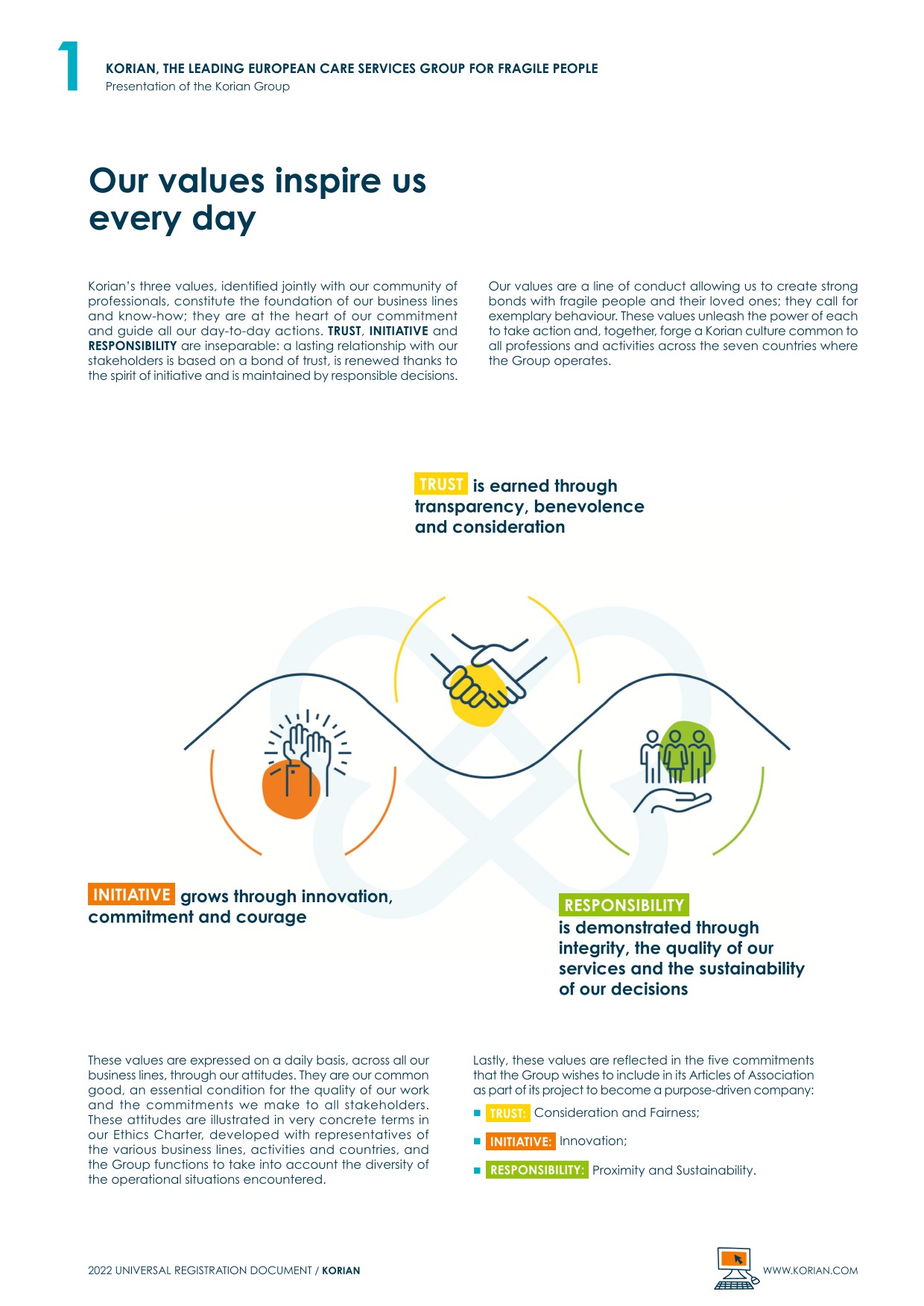

Values

THE THREE VALUES OF KORIAN'S CULTURE

These values, which are at the heart of Korian's culture, are inseparable: our long-term relationship with our stakeholders is built on a permanent bond of trust, is renewed continuously through a sense of Initiative, and sustained by responsible decisions.

These values can be seen in behaviours and attitudes that drawn on the Group’s DNA and guide everyone’s decisions in carrying out the Group’s mission:

- ■Trust is earned through transparency, benevolence and consideration;

- ■Initiative grows through innovation, commitment and courage;

- ■Responsibility is demonstrated through integrity, the quality of our services and our commitment to long-term sustainability.

Stakeholder dialogue and materiality matrix

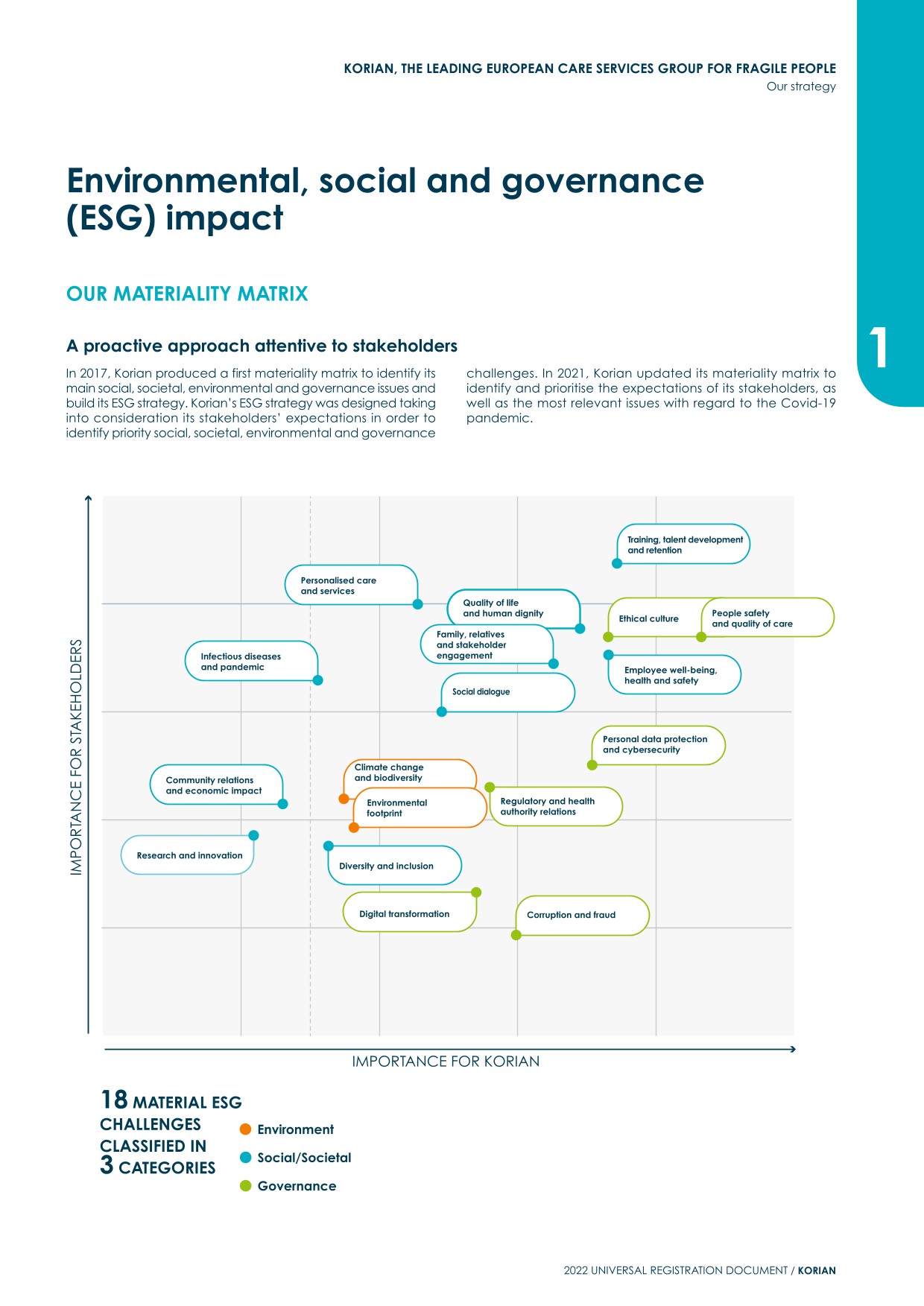

Korian’s ESG strategy was designed with consideration for its stakeholders’ expectations to identify priority social, societal and environmental challenges. In 2021, Korian updated its materiality matrix to identify and prioritise the expectations of its stakeholders, as well as the most relevant issues with regard to the Covid-19 pandemic.

In discharging their mission of caring for elderly or fragile people, the Group’s facilities are in close contact with various categories of stakeholders: residents, patients, as well as their relatives and caregivers, employees and their representatives, healthcare professionals, joint authorities and other public and local authorities. At the level of facilities, regions, countries and the Group, Korian is strengthening and structuring its model of stakeholder dialogue.

As a result, Stakeholder Councils are now in place in five of the Group’s seven countries (France, Germany, Belgium, the Netherlands and Italy). The Group has also supported the creation of independent foundations in France, Germany and Spain, whose governance bodies include representatives of the main stakeholders.

Stakeholders

Definition and scope

Dialogue channels

Fragile people, relatives and caregivers

Residents, patients, beneficiaries of services – in particular elderly or fragile people – as well as their families, relatives and caregivers.

- ■Social Life Committee/Users Commission

- ■Family relations

- ■Satisfaction surveys

- ■Digital applications

- ■Customer services

- ■Website and social networks

Employees, vocational trainees and their representatives

Employees, interns, apprentices and any person in training, as well as employee representatives and trade unions.

- ■Korian Start onboarding process, Training, Annual interviews

- ■Kommunity satisfaction surveys

- ■Internal communication: Intranet, newsletter

- ■Help line, whistleblowing system

- ■Social dialogue with social partners

Supervisory authorities, national and local authorities

National, regional and local authorities linked to the Group’s activities, elected officials and their representatives: for example, the Ministry of Solidarity and Health, French regional health agencies, and Departmental Councils in France.

- ■Social Life Committees

- ■Participation in various local consultation bodies dedicated to the economic and social development of the regions: Union Nationale des Missions Locales partnership, local employment and integration, etc.

- ■Partnership in France with the Union Nationale des Missions Locales

Regulators

Regulators of the health and medico-social sector: for example Haute autorité de santé, French regional health agencies.

Civil society, foundations, associations and NGOs

Foundations supported by the Group, civil society players – particularly professional associations, non-profit organisations, non-governmental organisations (NGOs) and volunteers working with the Group at a national, regional or local level.

- ■Foundations supported by the Group: scientific studies, platforms, etc.

- ■Themed conferences

- ■Press relations: press releases, breakfast, visits to facilities, etc.

Research, innovation and vocational training organisations

State-of-the-art university or hospital medical research facilities and innovation centres dedicated to health and longevity issues, as well as training facilities that deliver accredited degrees, qualifications or continuous education. For example, Fondation pour la Recherche Médicale (FRM), Institut Pasteur, the Toulouse Gérontopôle (geriatrics centre), etc.

- ■Partnerships

- ■Scientific studies

- ■Participation in conferences, seminars

Healthcare professionals and their representative bodies

Community of internal and external healthcare professionals who interact with the Group, patients, residents, recipients of services, as well as relatives; doctors and specialists, caregivers, nurses, psychologists, physiotherapists, dieticians, psychomotor specialists and pharmacy professionals, etc., along with their representative bodies.

- ■Social Life Committees

- ■Stakeholder Councils

- ■Facility Medical Commissions for the healthcare facilities

Business partners

Partner companies, suppliers and subcontractors, particularly in the agri-food, healthcare goods and equipment, design and construction, energy, water and waste sectors, etc.

- ■Responsible Purchasing Charter for suppliers

- ■Supplier agreements and trade fairs

- ■Professional organisations (Top AFEP)

Investors and other financial partners

Shareholders and holders of other equity or debt securities and instruments issued or guaranteed by the Group or any of its subsidiaries, banks and other financial institutions, as well as financial analysts, credit or non-financial rating agencies.

- ■Shareholders' General Meeting

- ■Investor days, conferences and meetings with investors and financial analysts, non-financial rating agencies

- ■Presentations, annual and half-year financial reports, press releases, Universal Registration Documents, etc.

Methodology

This materiality exercise was updated in 2021 based on feedback collected from all stakeholders across the Group's network in Europe, after the first wave of the Covid-19 pandemic.

Numerous discussion groups were organised in each of the Group’s countries. Nearly 2,000 people took part in these, including patients, residents, their relatives and families, Korian teams, trade union representatives, etc. As a second step, Korian analysed and classified this information, then supplemented it with the perceptions of investors and the media. Qualitative interviews were then conducted with the Group’s key managers, namely the Chairman of the Board of Directors, the Chief Executive Officer, the members of the Group Management Board (including the country Directors) and the main functional departments of the Group.

This process helped to refine the mapping of Group stakeholders and identify priority objectives according to their ESG impact, as related to:

A weighted assessment of priority issues was then carried out, mapped to both stakeholders' perceptions and Korian's.

This materiality matrix synthesises the five pillars of the Group's ESG strategy and the non-financial risk analysis (see below) to identify the areas Korian should prioritise in light of the expectations of its internal and external stakeholders.

Materiality matrix

This approach is an integral component of the business model presented in Chapter 1 of this Universal Registration Document.

In 2022, as part of the preparation for its transition to the status of a purpose-driven company, Korian also launched a consultation with its stakeholders to gather their opinions and expectations concerning the Company’s mission and main avenues for progress in achieving it (see details in Section 3.1.2).

ESG challenges

THE 5 PILLARS OF KORIAN'S ESG STRATEGY

OUR 18 MATERIAL ESG CHALLENGES

1

Provide care excellence whilst ensuring dignity and choice

- ■Quality of life and human dignity

- ■Family, relatives and stakeholder engagement

- ■People safety and quality of care

- ■Infectious diseases and pandemic

- ■Ethical culture

2

Be the employer of choice

- ■Employee well-being, health and safety at work

- ■Social dialogue

- ■Diversity and inclusion

- ■Training, talent development and retention

3

Contribute to finding innovative solutions for a more inclusive society

- ■Digital transformation

- ■Personalised care and services

- ■Research and innovation

4

Be a committed and responsible local partner

- ■Community relations and economic impact

- ■Regulatory and health authority relations

- ■Corruption and fraud

- ■Personal data protection and cybersecurity

5

Reduce our environmental footprint

- ■Climate change and biodiversity

- ■Environmental footprint

An ESG strategy focusing on five pillars, aligned with the Sustainable Development Goals (SDGs) and consistent with the corporate project

Korian’s ESG strategy aims to improve the Group’s social and environmental impact by operating in accordance with its values and taking into account the expectations of its internal and external stakeholders.

The strategy is broken down into five strategic and operational pillars, stemming from our corporate project. This strategy is implemented operationally through action plans, investments and objectives at Group, country and facility levels.

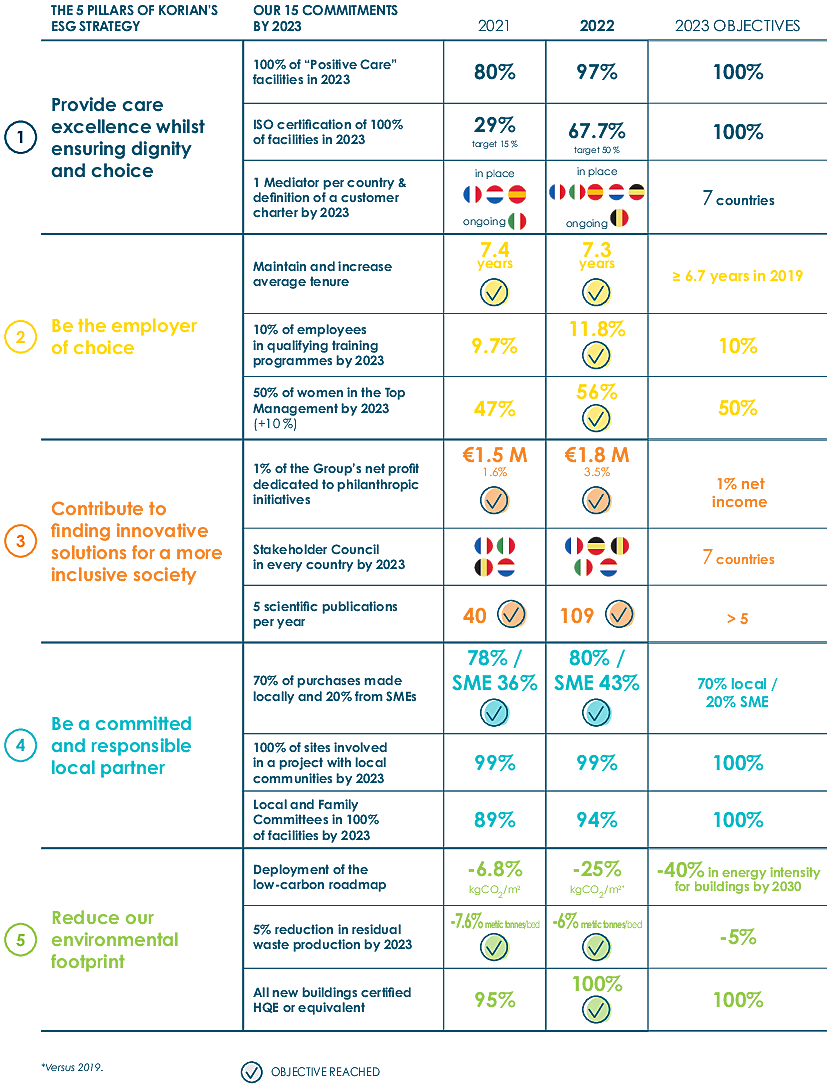

A roadmap focusing on 15 quantifiable and measurable ESG commitments

The Group has established a roadmap focusing on 5 pillars and 15 quantified ESG commitments, which meet and are based on the main international non-financial reporting standards (such as those of the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI) and the UN Sustainable Development Goals (SDGs)). These indicators are used to measure the progress of ESG performance. The Group’s CSR Department monitors this matter in conjunction with the countries and functional departments. Indicators are subject to reporting during monthly business reviews.

They are presented to the financial community alongside the publication of annual results, at conferences and in individual meetings with investors, and notably SRI investors.(1)

A correspondence table cross-referencing the SASB Healthcare Delivery industry standard is provided at the end of Chapter 3.

ESG commitments incorporated into annual and medium-term objectives

The ESG commitments are incorporated into the annual targets of each business line, distributed throughout the management chain, and assimilated in the long-term performance action plans for Top Management.(2)

ACHIEVEMENT OF THE ANNUAL OBJECTIVES FOR 2022

- ■The Net Promoter Score (NPS), measured through customer satisfaction surveys;

- ■A composite HR indicator: stabilisation of average tenure reduction in the frequency rate of work accidents with stoppage and 10% of the workforce enrolled in a qualifying training programme;

- ■Reduction in carbon emissions per sq. metre due to buildings' energy consumption versus 2019.

Annual objectives for 2023

In 2023, the non-financial criteria will be strengthened with an increased weighting in variable compensation. Five criteria are included in the objectives of Top Management:

- Continuous improvement of the Net Promoter Score (NPS), demonstrating Korian’s quality of service;

- Improvement in workplace quality-of-life, as measured by a “composite” HR indicator;

- The increase in the number of ISO 9001-certified facilities, in line with the 2023 roadmap, which aims for 100% ISO 9001-certified facilities by the end of 2023;

- The reduction in the energy consumption of our facilities, new objective in 2023;

- The quality of care, as measured by a composite indicator (for managers), new objective in 2023.

In 2022, the weight of the ESG indicators in the long-term variable compensation awarded to the Chief Executive Officer and Top Management was increased to 50% of the performance conditions. Furthermore, an additional indicator has been added for 2023.

The 2023 performance share plan includes the following three criteria: the reduction of carbon emissions, the percentage of women members of country management committees and within Top Management, and a composite indicator on the quality of care.

ESG RESULTS IN 2022 OF THE ESG ROADMAP FOR 2019-2023

Financing aligned with 3 of the 15 main ESG commitments

Korian’s ESG priorities are fully integrated in the Company’s financial strategy. A committee comprising representatives of the Finance and CSR departments meets monthly to measure the progress made in this area.

In June 2020, Korian became the first company in the sector to carry out a private bond placement (Sustainability Linked Euro PP) of €173 million, based entirely on non-financial performance criteria and with a maturity of eight years. An additional issue (tap) of €57 million was completed on 6 October 2020, bringing the total amount of the bond series to €230 million.

As a new milestone in the roll-out of the Group’s ESG strategy, this private offering was structured around 3 of the 15 main ESG commitments for 2023. This has strengthened investor confidence in the Group’s ambition and its non-financial objectives:

- ■as regards quality: achieve ISO 9001 certification for all facilities;

- ■as regards employees: double the proportion of staff members participating in qualifying training programmes to reach 8%;

- ■as regards society: reduce direct and indirect CO2 emissions.

Depending on the extent to which each of these targets are met, the interest rate on the bonds may be increased or reduced by up to 20 basis points. If the interest rate increases, half of the increase will be allocated to internal compensatory measures and/or paid to one or more external partners (such as associations or NGOs), the other half being paid to investors.

An independent body, tasked with reviewing the non-financial performance statement, verifies the achievement of the above commitments every year.

“Sustainability Linked Euro PP” private placement

KPIs

Objectives for 2022

Results and notes

Achievement

ISO 9001 certifications

50% of facilities ISO certified (based on a scope of 836 facilities in a position to obtain certification as at 31 December 2019).

At the end of 2022, the Group had an ISO 9001 certification rate of 67.7% of the European network considered for financing purposes, compared to 29% in 2021, 11% in 2020 and 8% in 2019.

The number of facilities in a position to be certified at 31 December 2019, i.e. 836 establishments, has been restated for the 55 establishments sold or closed in 2021 and 2022.

✔

Employees enrolled in qualifying training programmes

Have at least 7% of the employees enrolled in qualifying training programmes during the year, with a minimum of 5,250 people.

In 2022, 6,808 people, or 11.8% of the workforce, were enrolled in a qualifying training programme.

✔

Reduction of CO2 emissions

Pursuant to the notice sent to investors by Euroclear on 24 December 2021, the target for 2022 is to achieve a 2.3% reduction in CO2 emissions compared to the 2019 emissions, which amounted to 41 kgCO2/m2.

At the end of 2022, the Group posted a level of CO2 emissions of 30.7 kgCO2/m2, representing a 25% reduction in CO2 emissions compared to the 2019 emission levels.

✔

- ■a non-convertible green hybrid bond in the amount of £230 million, the purpose of which is to finance the modernisation, acquisition or development of real estate assets, mainly in the United Kingdom. The report on this financing was published on 15 June 2022 on the Korian website on the Sustainable Finance page (https://www.korian.com/en/sustainable-finance), accompanied by the certificate of partial allocation of funds provided by our auditors;

- ■a social bond in the amount of €300 million, based on social criteria, the proceeds of which will be used to finance the growing need for care in Europe, in medico-social and healthcare facilities, as well as in co-living residences or home care services provided by Petits-Fils. The report on this financing was published on 14 October 2022 on the Korian website on the Sustainable Finance page (https://www.korian.com/en/sustainable-finance), accompanied by the certificate of total allocation of funds provided by our auditors.

-

3.2Provide care excellence whilst ensuring dignity and choice for all

The quality of care and services is at the heart of our “In Caring Hands” corporate project, which emphasises respect for people, their dignity and their wishes within our facilities.

3.2.1Improving the autonomy of residents with the Positive Care approach

Korian has developed a dedicated therapeutic approach for its residents, in particular those suffering from dementia (neurodegenerative diseases). This approach focuses on the development and maintenance of autonomy, while taking into account the resident’s expectations and desires. This approach differs from care mainly based on drug treatment, which is not adapted to this type of pathology.

Positive Care, developed by the Group, is based on non-drug therapies, which aim to maintain and stimulate the residents’ physical, motor and cognitive capacities, according to their state of health. By preserving residents’ capacities, Positive Care aims to optimise their quality of life and well-being, by enabling them to express their wishes and make their own choices.

In practical terms, each resident undergoes a clinical assessment during his or her first 90 days, in order to determine his or her capacities and needs. At the end of this assessment, an individualised non-drug therapy plan is established, which takes into account the resident’s interests and life history and specifies the cognitive, functional and behavioural exercises adapted to the maintenance of his or her capacities.

This individualised therapeutic strategy is based on experience and clinical evidence. By training the brain one can compensate for some of the lost capacity related to ageing. Positive Care relies on and encourages natural brain plasticity to prevent and treat fragility and psycho-behavioural disorders related to brain ageing.

- ■research by Prof Gerald Maurice Edelman, an American biologist and the 1972 Nobel Prize winner in Medicine, who demonstrated the fundamental role of residual brain plasticity in adaptive behaviour;

- ■research by Prof Matthew D Lieberman, Professor of Neuroscience and Director of Social Cognitive Neuroscience at the University of California, Los Angeles (UCLA), whose approach encourages social distractions to induce engagement and learning, and to capitalise on untapped neurocognitive resources.

Since 2015, Korian’s Medical, Ethics and Quality-of-Service Department has formalised the Positive Care approach in order to define and translate it operationally. This work has enabled:

- ■the design of non-drug therapies together with their integration, exclusion and assessment criteria on the one hand, and the associated protocols (therapeutic sequences and frequency) on the other;

- ■the consolidation of available therapies in the form of a tree diagram;

- ■assessment of the contribution of each business line to this therapeutic project led by multidisciplinary teams.

The European Positive Care Committee, which brings together the healthcare teams of the countries where the Group operates, has also set out the operational tools required to deploy the Positive Care approach and to support the teams in its implementation, across the Group’s European network, namely:

- ■a set of non-drug therapies tailored to national preferences and skills and by selecting only therapies that have been the subject of scientific publications;

- ■a set of training courses related to these therapies to enable both the appropriation of the therapeutic objectives and proper use of the tools made available;

- ■a basic methodology that promotes the resident-centred approach and the understanding of the challenges of the pathology (Hoffman method, Montessori method, Böhm method, etc.).

Deployment is monitored at Group level, in conjunction with the Positive Care Officers in each country.

This implementation is an integral part of the Group’s ESG strategy and objectives, with the aim of deploying Positive Care in all long-term care nursing homes by the end of 2023.

At the end of 2022, Positive Care non-drug therapy equipment, and the associated training courses, had been rolled out in 97% of the Group’s specialised nursing homes.(3)

The Group’s Positive Care approach – initially focused on non-drug therapies – is being redefined more broadly to include the living conditions, the layout of spaces, the organisation of facilities and the training of teams, in order to individualise the care of residents as much as possible, and more particularly of those suffering from dementia, in accordance with their desires and their needs. This re-definition also aims to extend the Positive Care approach to all of the Group’s activities.

-

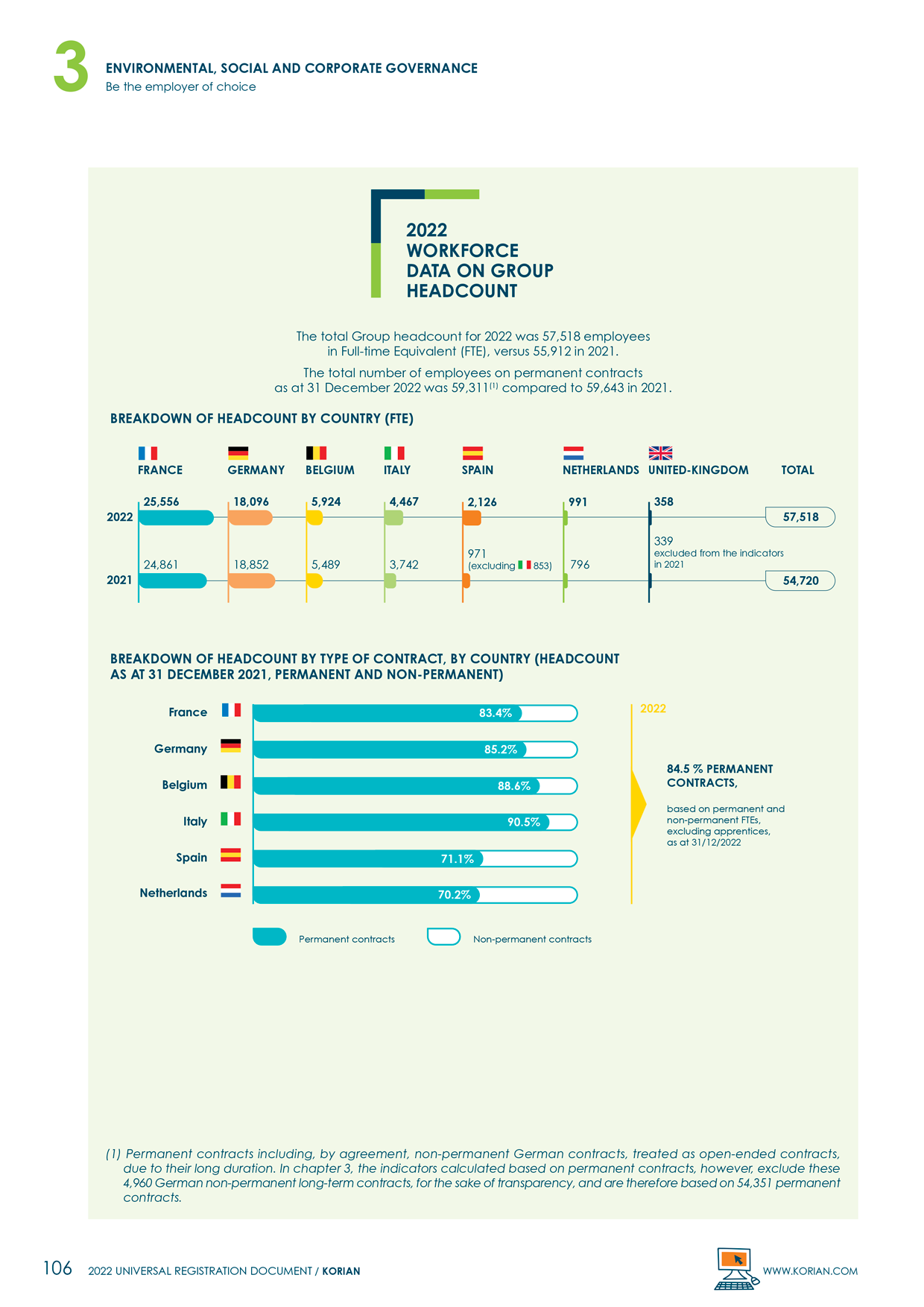

3.3Be the employer of choice

3.3.1The Korian human resources policy

Korian’s human resources policy, based on the Company’s values – trust, initiative and responsibility – is at the heart of the corporate project “In Caring Hands”, dedicated to the service sector for elderly or fragile people and those with loss of autonomy for whom the quality of care and support provided is essential.

The growth of Korian’s activities requires the ability to attract and develop a wide variety of talent across different professions, in particular caregivers, nurses, doctors, cooks, as well as job roles related to the personal services activities Korian offers (home caregivers for elderly people, care providers, reception staff, etc.).

However, despite the increasing jobs created in the sector, the number of long-term care nursing home workers in relation to the number of people over the age of 65 has stagnated in recent years and the number of people enrolled in caregiver training has remained flat. All the countries where the Group operates are facing a shortage of healthcare workers, exacerbated by the Covid-19 pandemic. According to the Organisation for Economic Co-operation and Development (OECD) and various other European statistical sources, the shortage of caregivers is estimated to reach hundreds of thousands of caregivers per year by 2030.

Developing the attractiveness and appreciation of professions related to elderly and fragile people is, therefore, an essential priority for Korian, to ensure it is able to guarantee excellence and continuity of care for residents and patients.

- ■the implementation of an ambitious social foundation for candidates and employees who hold or will occupy these roles, in terms of working conditions, health at work or quality of life at work, and also opportunities for training, to develop their skills and move towards more qualified and better paid positions.

- This social foundation is made possible and supported by a high-quality managerial culture that safeguards the Group’s values and is based on a managerial model driven by our Facility Directors and their teams, the cornerstones of the network;

- ■anticipating the recruitment and skills development needs for our activities. This requires social innovations to secure and expand our external and internal talent base;

- ■an organisation that allows everyone to have a real capacity for action with residents and patients, but also with communities and local stakeholders, in order to support business growth in all the regions where the Group operates.

To meet these various challenges in a context of strong growth, scarcity and volatility of resources, Korian’s Human Resources policy is organised around three priority strategic areas:

-

3.4Contribute to finding innovative solutions for a more inclusive society

3.4.1 Foundations associated with the Korian Group

- ■the Korian Foundation, a corporate foundation created in France in September 2017;

- ■the Korian Foundation for Care and Ageing Well, created in Germany in early 2020.

- ■support and participate in scientific research programmes to advance scientific knowledge and also to tangibly improve the support of residents and patients, the quality of care and the working conditions of caregivers;

- ■conduct societal studies to change views on ageing and contribute to thinking about and inventing a longevity society. This means changing our perspective on ageing and promoting and supporting care occupations and those that support the most fragile, including by inspiring new vocations;

- ■support solidarity actions to combat the isolation of elderly people, promote the professional integration of young people from disadvantaged neighbourhoods, improve access to legal rights and care for caregivers and women in difficulty. The Boards of Directors of the foundations are composed of figures who are internal and external to Korian, divided into three colleges: representatives from the Group, Group employees and representatives of the foundations’ Scientific Boards.

In addition, the foundations benefit from the input and leadership of the members of their Scientific Boards: researchers and academics, practitioners, caregivers, designers, association managers, etc.

The foundations also surround themselves with partners who are both recognised in the field of clinical research and in human and social sciences, along with industrialists and actors from the social and solidarity economy, to galvanise genuine scientific cooperation.

To these two foundations is added the FITA foundation created in 2002 by Ita Salud Mental, a mental health specialist in Spain acquired by the Korian group in 2021.

Taking a research, action and training approach, the professionals of the Korian facilities (medical, paramedical and caregivers) are involved in the development and implementation of scientific protocols in order to ensure their relevance and their feasibility in terms of expertise and needs.

The research also involves residents and patients of Korian facilities (long-term care nursing homes and healthcare facilities) who volunteer to participate.

3.4.1.1The Korian Foundation in France

Created in 2017 for a first five-year cycle, the French Foundation of the Korian group had set itself the objective of contributing to the reflection on Ageing Well, by conducting a series of studies with the IPSOS institute on how people view ageing, by supporting initiatives to promote the social inclusion of elderly people and to promote oral archives, and more broadly by encouraging various applied medical research projects aimed at improving the physical and psychological support provided to elderly people and their families and caregivers, at home and in medico-social or healthcare facilities.

In five years, 15 research projects have been completed, resulting in 30 publications; three prizes have been awarded to associations particularly involved in these themes, while 29 platforms and 21 morning sessions have been organised in Paris and 16 cities in the regions, bringing together a total of nearly 5,200 representatives of associations and professionals in the field of ageing for face-to-face discussions.

In 2022, the Foundation continued its actions to transmit and promote the voice of elderly people through two emblematic projects:

“Territoires et mémoires de vie” (Territories and Memories of Life) – Part 2: One of the missions of the Korian Foundation for Ageing Well is to give a voice to elderly people and carry their voices, their life stories, sharing and promoting their experiences. In this book entitled “Territoires et mémoires de vie”, the Korian Foundation gives the floor to residents who live in nursing homes. For the past two years, the Foundation has been studying local communities and the impact that living spaces can have on our history. After Marseille, the biographer Régine Zohar turned to Bordeaux, collecting the life stories of residents at the Villa Gabriel, Villa Louisa, Villa Bontemps and Clos Serena long-term care nursing homes.

Season 4 of the “La Voix des Aînés” podcast, entitled “Ecology once upon a time”: As the climate and environmental emergency forces us to rethink our lifestyles and consumption, the Foundation wished to let elderly people speak about this topic and share their memories of a time when people were inventive and thrifty out of necessity.

In addition to the projects carried out in favour of Ageing Well, the Foundation supports solidarity actions for four target audiences:

- ■isolated elderly people;

- ■caregivers;

- ■women in difficulty;

- ■young people in priority education areas.

In 2021, the Foundation, together with Fondation Agir Contre l’Exclusion (FACE), launched solidarity workshops to improve employees’ access to rights in healthcare and medico-social facilities. Designed with the support of Korian’s social services and organised by the Korian Foundation, they are led by FACE clubs and structures in the regions. In 2021 and 2022, 47 Group healthcare facilities and long-term care nursing homes and 900 participants benefited from these workshops.

The partnership with the Alliance for Education, aimed at introducing middle-school and high-school students in priority education areas to the elderly care professions, also continued, through the participation of Group employees in five job forums and the hosting of 15 interns under the programme.

The Foundation supports the mobile campaign of the Bus du Coeur, which is led by the Agir Pour le Cœur des Femmes Foundation, which aims to inform, raise awareness and prevent cardiovascular diseases in women. In 2022, the Bus du Cœur campaign enabled 5,000 women to be screened in 14 cities in France.

As part of the Group’s support for the fight against violence against women, the Foundation has a partnership with the Maison des Femmes in Saint-Denis, enabling victims (Korian employees or not) to access social, medical and legal support. The Foundation provides funds for two night nurses.

At the end of this first five-year cycle, the Foundation decided to devote its new cycle of work starting in 2023 to the theme: “Loving to care”. It intends to dedicate its actions to caregivers, care professions and healthcare organisations. The Korian Foundation has identified three key areas for reflection:

- ■the physical and moral health of caregivers: prevention and support, fight against burnout, social inclusion and work-life balance, etc.;

- ■the attractiveness of the care professions: professional recognition, social representation of caregivers, diversity of professions and profiles, new generations and new expectations, etc.;

- ■the meaning of the job: organisational ethics, new forms of management, teamwork and time management, etc.

3.4.1.2Korian Foundation for Care and Ageing Well in Germany

The well-being of caregivers and more generally of people active in the care sector is a key focus of the Korian Foundation’s actions in Germany. In 2022, stress reduction was at the heart of the Foundation’s work through the distribution of healthy recipes that take into account the pace of work in facilities and aromatherapy training. The Foundation has also published a guide for professionals in the care sector on the topic of end-of-life support, death and bereavement. It aims to offer them tools to support the people concerned and their families and support them in managing the emotional burden associated with this mission.

In December 2022, the German Foundation, in partnership with Korian Germany, the University of Bremen and the Fraunhofer IIS research institute, also launched the “Care 2030” (Pflege 2030) project. The Korian Haus Curanum facility in Karlsfeld was selected to pilot this three-year project, supported by a €3.1 million grant from the Bavarian Ministry of Health and Care, which aims to project itself into the near future of the healthcare sector. The contributions of new technologies and innovative planning methods to the quality of care and working conditions will be studied through their experimentation at the Karlsfeld site.

3.4.1.3The FITA foundation for mental health in Spain

In Spain, Ita Salud Mental, a mental health specialist acquired by the Korian group in 2021, created the FITA foundation in 2002. Its mission is to contribute to the prevention, awareness and understanding of mental health problems. More specifically, its programmes aim to:

- ■promote emotional well-being;

- ■facilitate the early detection of mental disorders;

- ■contribute to the reduction of their stigma;

- ■support and guide affected people and their families in accessing treatment.

- ■care and rehabilitation programmes dedicated to supporting people suffering from or having suffered from mental disorders and helping them towards autonomy and social inclusion. The Foundation’s objective is to be able to meet the diversity of needs through these programmes: accommodation in transitional housing, psychological support, support in day-to-day management, academic guidance, professional integration, financing assistance for treatment. In 2021, 179 people were supported through these programmes, mostly at the end of or after treatment, and 89 relatives and/or education and social action professionals were advised by the Foundation’s teams;

- ■prevention and training programmes: workshops for the general public, continuing training for education and social action professionals. In 2021, 1,300 people took part in prevention workshops and 320 professionals were trained;

- ■awareness-raising actions based on the testimonials of people who have experienced mental health problems, through interventions in schools or the publication of novels written based on these testimonials.

-

3.5Be a committed and responsible local partner

3.5.1Contribution to regional economic and social development

Korian plays an active role in the economic and social development of the communities in which it operates. The Group has more than 1,200 facilities located as close as possible to local communities and employment areas, often close to priority urban areas, but also in rural areas and in “medical deserts”.

A new facility boosts the local economy. For example, in France, a long-term care nursing home or a specialised clinic with around 100 residents and patients represent respectively between 60 and 120 direct jobs that cannot be relocated. In addition to creating stable jobs that cannot be relocated, the opening of a facility contributes to the local economy, both through the building’s maintenance and the purchase of goods and services necessary for its operations.

Petits-fils, the specialist in home care services for elderly people, ranked number 36 on the list of companies that are hiring the most in France (2022 ranking published by Le Figaro).

Ages & Vie shared housing also contributes to regional integration in rural areas. These homes are inclusive solutions located in the heart of small towns and neighbourhoods, near healthcare centres, local shops, schools and associations. Elderly people thus remain in their home environment. Welcoming to relatives and friends, they facilitate exchanges with residents' families. The homes are connected to their communities and welcome multiple generations under one roof (in some facilities, caregivers live with their families in staff accommodation on the first floor). They thus offer an intergenerational environment to elderly residents. From the start, the Ages & Vie concept was designed and developed in partnership with municipalities. It closely matches the needs of mayors looking for an innovative solution that creates jobs, in line with the expectations of their constituents.

By their very nature, our services aim to be local services with a strong commitment to an economy of social inclusion and solidarity.

Creation of the Companies and the Common Good Chair

In order to explore and qualify the mechanisms and actions through which the Company contributes to the common good and to generating economic and societal value in the regions where it operates, the Korian group created the ICP-ESSEC Companies and the Common Good Chair in 2021 in partnership with ICP, ESSEC and six other partner companies (Saint-Gobain, Bayard, Grant Thornton France, Meridiam, Eurazeo and Kea & Partners). The aim of the Chair is to develop multidisciplinary research around the notion of the common good applied to companies. In particular, it has created a “Company and Common Good” university diploma as an initial degree and continuing education, in which two Korian group employees participate every year. In 2022, the Chair began a research programme on the contribution of companies to the common good through their local presence, which runs until 2024. The research areas are as follows: studying the conditions for a successful regional anchoring policy and measuring the impact of companies at the level of local communities.

-

3.6Reduce our environmental footprint

3.6.1European Taxonomy

Regulation (EU) 2020/852, known as the European Taxonomy Regulation, is a key element of the European Commission’s action plan to redirect capital flows towards a more sustainable economy. To this end, the European Taxonomy sets a classification system for environmentally sustainable economic activities.

As a non-financial company, below Korian presents the share of the Group’s revenue, capital expenditures (CapEx) and operating expenses (OpEx) for the 2022 financial year which are associated with taxonomy eligible activities under the first two environmental objectives (mitigation of climate change and adaptation to climate change), in accordance with Article 8 of the Taxonomy Regulation and Article 10 (2) of the Delegated Act supplementing Article 8. The analysis covers all Group entities (scope of fully consolidated entities).

Analysis of the Group’s activities with regard to the European Taxonomy Regulation

The Korian group has identified among its various activities (see Section 1.1 of the Universal Registration Document for the presentation of the Group’s activities) those covered by the European Taxonomy Regulation with regard to the two climate objectives:

Target

Activity listed in Annex II of Delegated Regulation (EU) 2021/2139

Description of Korian’s activities

Eligibility

Revenue

CapEx

OpEx

1 - Mitigation of climate change

7.1 Construction of new buildings

Sales of furnished apartments for non-professional leasing

(Ages & Vie)Eligible

Eligible

Eligible

7.7 Acquisition and ownership of buildings

Residential solutions (assisted living facilities and shared housing for elderly people)

Eligible (rent only)

Eligible

Eligible

2 - Adaptation to climate change

12.1 Residential care activities

Long-term care nursing homes

Ineligible

Eligible

Eligible

Post-acute and rehabilitation care clinics and mental health clinics (excluding outpatient solutions)

Ineligible

Eligible

Eligible

The Group’s long-term care nursing home activities are part of Objective 2, adaptation to climate change, Section 12.1 “Residential care activities”. Due to the similarity of the services (extended accommodation and medical care) of post-acute and rehabilitation care clinics and mental health clinics (excluding outpatient solutions), the latter are also considered to be relevant to Section 12.1.

Methodology and calculation

a)Share of revenue associated with taxonomy eligible activities

The share of revenue associated with activities eligible for the European Taxonomy was determined based on the segmentation of revenue by activity in the Group’s information systems and reconciled to the line “Revenue and other income” of the consolidated financial statements as at 31 December 2022 (see Chapter 6, Section 6.1 of this document).

Pursuant to Delegated Regulation 2021/4987 published by the European Commission on 6 July 2021 (Appendix I 1.1.1), the revenue from long-term care nursing home and healthcare facility activities meeting Objective 2 “Adaptation to climate change” was excluded due to the non-qualifying nature of the activity.

Only revenue corresponding to rents received from residential solutions (Activity 7.7 “Acquisition and ownership of buildings”) and sales of furnished apartments for non-professional leasing (Activity 7.1 “Construction of new buildings”) is considered eligible.

This resulted in a percentage of Group eligible revenue of 1% for the 2022 financial year. This percentage stems directly from the classification of the Group’s activities as established by the current texts, which do not consider the medico-social housing business, Korian’s main activity, as qualifying under adaptation criteria. This figure does not in any way reflect the Group’s commitment to reducing its carbon emissions. However, these activities are included in the basis for calculating the eligibility ratios for CapEx.

Given the insignificant amount of eligible revenue related to Activity 7.1 “Construction of new buildings” and 7.7 “Acquisition and ownership of buildings”, the Group has not carried out any alignment analysis concerning the revenue generated by these activities.

Substantial contribution criteria

No significant harm criterion

Economic activities

Code(s)

Absolute revenue

Share of revenue

Mitigation of climate change

Adaptation to climate change

Aquatic and marine resources

Circular economy

Pollution

Biodiversity and ecosystems

Mitigation of climate change

Adaptation to climate change

Aquatic and marine resources

Circular economy

Pollution

Biodiversity and ecosystems

Minimum guarantees

Share of

revenue aligned with the taxonomy, year NShare of

revenue aligned with the taxonomy,

year N-1Category (enabling activity)

Category (transitional activity)

€m

%

%

%

%

%

%

%

YES / NO

YES / NO

YES / NO

YES / NO

YES / NO

YES / NO

YES / NO

%

%

M

T

A. Activities eligible for the taxonomy

A.1 Environmentally sustainable activities

(aligned with the taxonomy)Construction of new buildings

7.1

-

-

-

Acquisition and ownership of buildings

7.7

-

-

-

Revenue from environmentally sustainable activities (aligned with the taxonomy) (A.1)

0

0%

0

0

0

0

0

0

0%

A.2 Activities eligible for the taxonomy but not environmentally sustainable

(not aligned with the taxonomy)Construction of new buildings

7.1

1

0%

Acquisition and ownership of buildings

7.7

53

1%

Revenue of the activities eligible for the taxonomy but not environmentally sustainable

(not aligned with the taxonomy)54

1%

Total revenue of the activities eligible for the taxonomy

(A.1 + A.2) (A)54

1%

0%

B. Activities not eligible for the taxonomy

Revenue from activities not eligible for the taxonomy (B)

4,480

99%

TOTAL A + B

4,534

100%

b)Share of capital expenditure (CapEx) associated with taxonomy eligible activities

The share of CapEx associated with the eligible activities was calculated on the basis of the amounts paid for the acquisition of tangible and intangible assets and increases in rights of use, including those resulting from business combinations, associated with the eligible activities of the Group.

The CapEx segmentation by activity was carried out on the basis of the right-of-use assets broken down by entity and the Group’s capital expenditure reporting and reconciled to the consolidated financial statements as at 31 December 2022 (see Chapter 6, Note 5 “Goodwill, intangible assets and property, plant and equipment”). The CapEx of small amounts (amounts of less than €1 million) or that cannot be allocated to a single activity (for example headquarters CapEx, IT CapEx, maintenance CapEx not detailed) as well as increases in rights of use were excluded.

At 31 December 2022, the share of eligible and aligned CapEx amounted to 29% and 12% respectively, details of which are presented in the table below.

Substantial contribution criteria

No significant harm criterion

Economic activities

Code(s)

Absolute CapEx

Share of CapEx

Mitigation of climate change

Adaptation to climate change

Aquatic and marine resources

Circular economy

Pollution

Biodiversity and ecosystems

Mitigation of climate change

Adaptation to climate change

Aquatic and marine resources

Circular economy

Pollution

Biodiversity and ecosystems

Minimum guarantees

Share of CapEx aligned with the taxonomy, year N

Share of

CapEx aligned with the taxonomy, year N-1Category (enabling activity)

Category (transitional activity)

€m

%

%

%

%

%

%

%

YES / NO

YES / NO

YES / NO

YES / NO

YES / NO

YES / NO

YES / NO

%

%

M

T

A. Activities eligible for the taxonomy

A.1 Environmentally sustainable activities

(aligned with the taxonomy)Construction of new buildings

7.1

-

-

100%

0%

-

Acquisition and ownership of buildings

7.7

87

7%

100%

0%

YES

YES

7%

Residential care activities

12.1

53

4%

0%

100%

YES

YES

YES

4%

CapEx of the environmentally sustainable activities (aligned with the taxonomy) (A.1)

140

12%

62%

38%

0

0

0

0

12%

A.2 Activities eligible for the taxonomy but not environmentally sustainable

(not aligned with the taxonomy)Construction of new buildings

7.1

-

-

Acquisition and ownership of buildings

7.7

-

-

Residential care activities

12.1

207

17%

CapEx of activities eligible for the taxonomy but not environmentally sustainable

(not aligned with the taxonomy)207

17%

Total CapEx of the activities eligible for the taxonomy

(A.1 + A.2) (A)347

29%

12%

B. Activities not eligible for the taxonomy

CapEx of the activities not eligible for the taxonomy (B)

836

71%

TOTAL A + B

1,183

100%

Activity 7.1 Construction of new buildings

Given the absence of CapEx related to Activity 7.1 “Construction of new buildings”, the Group focused on Activity 7.7 “Acquisition and ownership of buildings”.

Activity 7.7 Acquisition and ownership of buildings

As summarised in the previous analysis table, all of the Group’s CapEx for Activity 7.7 “Acquisition and ownership of buildings” are considered eligible.

In order to analyse the alignment of Activity 7.7 “Acquisition and ownership of buildings” as part of the climate change mitigation objective, the Group focused on investments related to Ages & Vie (which is its alternative housing offering in France) and applied the criteria of substantial contribution and the DNSH prescribed by Appendix 1 to the regulations.

Substantial contribution criterion

For buildings with a building permit dated after 31 December 2020, the analysis was carried out on the basis of the “NZEB minus 10%” thresholds, i.e. “RT 2012 minus 10%” for buildings with building permits filed under the 2012 Thermal Regulation or “RE 2020” for buildings with a building permit filed under the 2020 Environmental Regulation.

For buildings with a building permit dated prior to 31 December 2020, the analysis was based on the energy performance certificates and the primary energy consumption thresholds of the top 15% established, in France, by the Sustainable Real Estate Observatory (Observatoire de l’Immobilier Durable);

DNSH

As the Group is located in Europe, Korian has considered as material the climate risks related to heat waves, drought, soil degradation, severe weather and coastal erosion for its centres close to the sea.

To carry out the physical climate risk analyses, Korian based itself on the pessimistic projections of the IPCC on the lifespan of its buildings (Scenario 8.5). These analyses were carried out on all Ages & Vie sites under construction in 2022.

When a building was particularly exposed to a risk given its geographical position, a plan identifying actions for adapting the asset to the climate risk in question as well as the actions to be implemented was decided.

Activity 12.1 Residential care activities

Concerning Activity 12.1 “Residential care activities”, as it concerns an adaptation activity within the meaning of the taxonomy, an analysis of the physical climate risks (as described in the previous paragraph) and the implementation and definition of an adaptation plan are required in order to consider the CapEx as eligible. Such analyses were carried out during the 2022 financial year for a selection of assets in France and Europe in order to assess whether their CapEx related to new construction of facilities, property buybacks and external growth were eligible. No extrapolation was carried out for assets that were not analysed for physical climate risks, which were therefore considered ineligible.

With regard to the DNSH Pollution relating to Activity 12.1, the Group has validated the existence of a waste management plan for each country where it is present, treating the toxic and pharmaceutical waste, while promoting the recycling and reuse of the other types of waste.

In accordance with the details provided by the European Commission on 19 December 2022, Korian has retained as aligned within the meaning of Activity 12.1:

- ■only climate change adaptation CapEx for existing buildings;

- ■for buildings under construction, all CapEx related to the building are taken into account considering that the adaptation measures are included in the various characteristics of the building (for example, the materials used, the depth of the foundations, etc.) and that it is not possible to identify them separately. In addition to the physical climate risk analyses carried out as part of the eligibility, the new standards in force in the countries of these new constructions promote the adaptation to climate change of the building as a whole.

c)Share of operating expenses (OpEx) associated with taxonomy eligible activities

The overall amount of the Korian group’s operating expenses meeting the definition of the Taxonomy represented 3.0% of total consolidated operating expenses for the 2022 financial year, i.e. €104 million for total operating expenses of €3,531 million. The Group has chosen to apply the materiality exemption allowed by Paragraph 1.1.3.2 of Appendix I of the Delegated Regulation of July 2021.

Substantial contribution criteria

No significant harm criterion

Economic activities

Code(s)

Absolute OpEx

Share of OpEx

Mitigation of climate change

Adaptation to climate change

Aquatic and marine resources

Circular economy

Pollution

Biodiversity and ecosystems

Mitigation of climate change

Adaptation to climate change

Aquatic and marine resources

Circular economy

Pollution

Biodiversity and ecosystems

Minimum guarantees

Share of OpEx aligned with

the taxonomy, year NShare of OpEx aligned with the taxonomy, year N-1

Category (enabling activity)

Category (transitional activity)

€m

%

%

%

%

%

%

%

YES / NO

YES / NO

YES / NO

YES / NO

YES / NO

YES / NO

YES / NO

%

%

M

T

A. Activities eligible for the taxonomy

A.1 Environmentally sustainable activities

(aligned with the taxonomy)OpEx of the environmentally sustainable activities (aligned with the taxonomy) (A.1)

0

0%

0%

A.2 Activities eligible for the taxonomy but not environmentally sustainable

(not aligned with the taxonomy)OpEx of activities eligible for the taxonomy but not environmentally sustainable

(not aligned with the taxonomy)

Total OpEx of activities eligible for the taxonomy

(A.1 + A.2) (A)0%

B. Activities not eligible for the taxonomy

OpEx of activities not eligible for the taxonomy (B)

TOTAL A + B

104

100%

Minimum guarantees

Korian has ensured compliance with the minimum guarantees. In particular, the Group is subject to and complies with the obligations of the Sapin 2 and Duty of Vigilance acts (see Chapter 3, Section 3.7). All of the Group’s processes related to human rights, labour law, business ethics (see Chapter 3, Section 3.5.6), corruption and taxation (see Chapter 3, Section 3.5.7) are in place and ensure compliance with the requirements of the Taxonomy Regulation. Korian also verifies the quality of its suppliers by auditing them in order to verify the correct application of its Responsible Purchasing Charter and Ethics Charter (see Chapter 3, Section 3.5.2).

-

3.7Group Vigilance Plan

The Group is subject to French Act No. 2017-399 of 27 March 2017 pertaining to the corporate duty of vigilance incumbent on parent companies and contracting companies. As such, Korian is required to establish and implement a vigilance plan covering the activities conducted by the Group and any subsidiaries it owns.

The Vigilance Plan sets out the reasonable vigilance mechanisms in place with a view to identifying and preventing:

- ■serious violations of human rights and fundamental freedoms;

- ■violations of personal health and safety;

- ■harm to the environment,

ensuing from activities conducted by the companies owned by Korian, or resulting from the activities carried out by subcontractors or suppliers with which Korian has an established business relationship.

- ■risk mapping system;

- ■regular assessment procedures for subsidiaries, subcontractors and suppliers;

- ■appropriate risk mitigation and prevention measures;

- ■whistleblowing mechanism and alert reception system;

- ■system for tracking the measures implemented and assessing their effectiveness.

The Vigilance Plan first sets out the governance matters relating to the duty of vigilance, the methodology for devising a Vigilance Plan, and the whistleblowing mechanism covering all risks identified in respect of the duty of vigilance.

The table presented on the following pages lists all of the mechanisms in place (assessment procedures, mitigation actions, tracking systems for the measures used) and the results of these in respect of each of the main risks identified. Cross-referencing is included whenever these systems are detailed in another section of the Universal Registration Document.

Governance

The implementation of the Vigilance Plan is managed by the General Secretariat, integrating the key functions. The development and deployment of the Vigilance Plan are presented to the Risk, Ethics and Compliance Committee, which meets bimonthly (see Section 1.5).

The General Secretariat decides on the action priorities and the evolution of the plan in close coordination with the Group CSR Department as well as with the Audit Department through a control questionnaire including action points relating to CSR and the duty of vigilance. The Group’s subsidiaries also actively participate in the deployment of the plan through their local manager in charge of implementing compliance actions within their scope.

-

3.8Appendices

3.8.1SASB HEALTHCARE DELIVERY CROSS-REFERENCE TABLE

The Sustainability Accounting Standards Board (SASB) is an American non-profit organisation that has developed a system for classifying industries according to their ESG risks and opportunities. The SASB standards identify environmental, social and governance issues related to the financial performance of each industry, in order to propose indicators of the company's value that are relevant to both investors and companies. As the SASB standards are based on American practices and regulations, some of the indicators are therefore not applicable to the Group.

In 2021, Korian published for the first time a reconciliation of the data included in its Universal Registration Document with the SASB Healthcare Delivery standard, to which the Group adheres.

However, the Healthcare Delivery activity is only one component of the Group’s business (described in Chapter 1 of this Universal Registration Document). The residents and patients of the Group’s post-acute and medico-social facilities are monitored medically (mainly for chronic pathologies), but the Group has no hospital activities and its surgical clinics are located solely in Italy. Some of the indicators of this standard do not, therefore, apply to the Group’s business. In such cases, the Group has proposed, where possible, an alternative indicator to address the topic.

SASB Code

SASB metric

SASB category

SASB measurement unit

2021

Information published by Korian

URD Section

Energy management

HC-DY-130a.1

(1) Total energy consumed, (2) Percentage of grid electricity,

(3) Percentage of renewable energy

Quantitative

Gigajoules (GJ)

Percentage (%)

(1) Korian publishes the total energy consumed in kWh:

Total energy consumption: 725,336,917 kWh in 2022.

(2) 36% electricity.

(3) Korian does not publish the percentage of renewable energy.

For more information, see the paragraph opposite.

3.6.3

Waste management

HC-DY-150a.1

Total amount of medical waste,

percentage (a) incinerated, (b) recycled or treated and (c) landfilled

Quantitative

Metric tons (t)

The quantity of infectious medical waste was 7.3 metric tons per bed in 2022 (see the opposite paragraph). This waste is collected and processed using regulatory channels in the countries in which Korian operates. Korian does not have information on this processing.

3.6.4.4.3

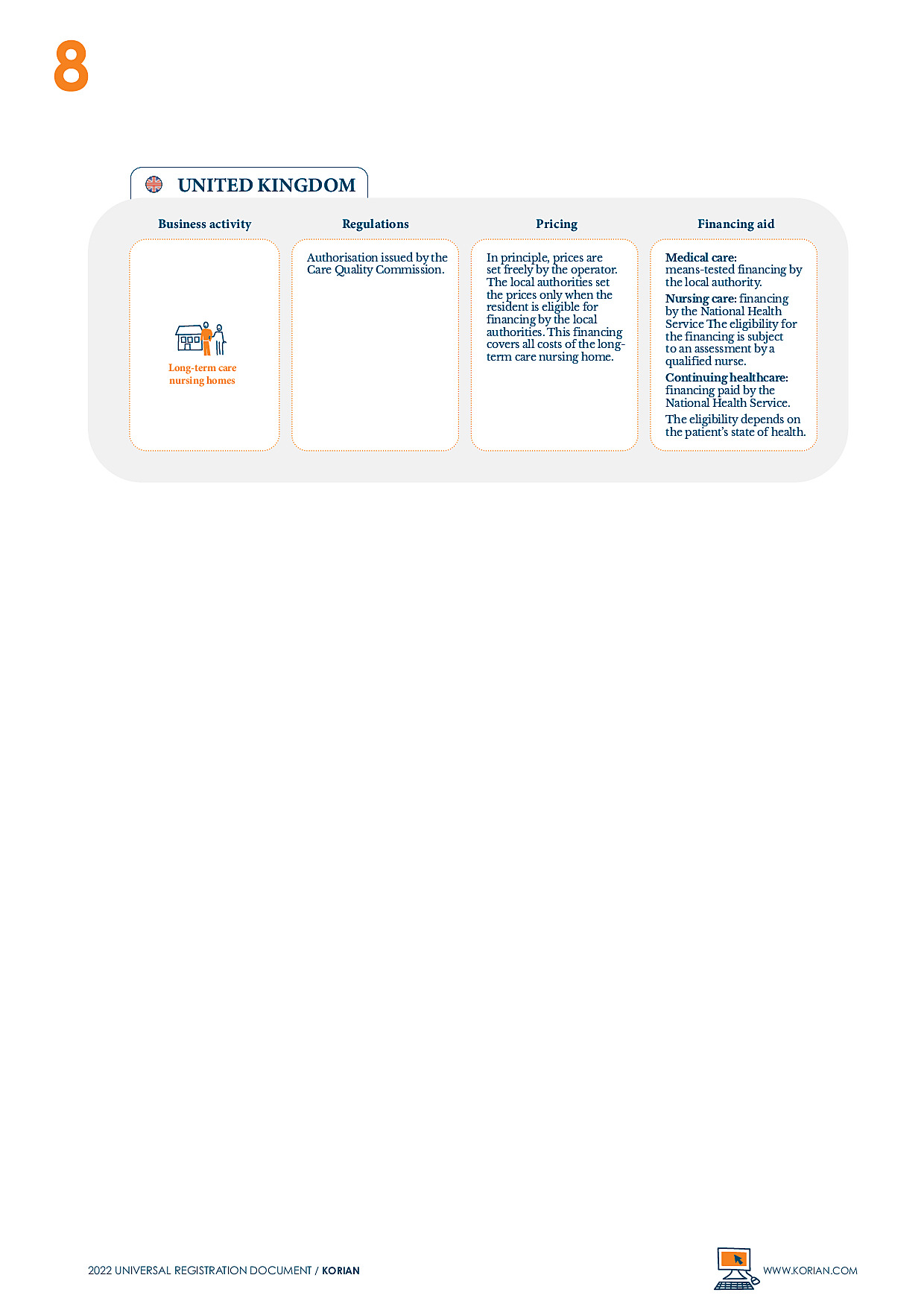

HC-DY-150a.2